Market Wrap 2026-01-04

Today's US Market Wrap — Key Points

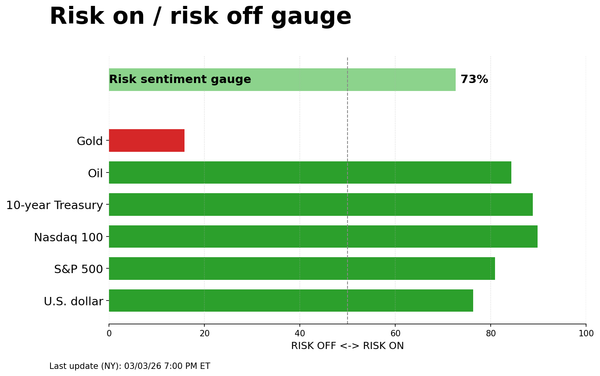

- Stocks mixed, Treasury yields up, oil down, dollar up, gold up.

- Focus on US/Canada jobs data, PMIs, Eurozone/China inflation.

- Potential Fed Chair pick & OPEC+ meeting key events next week.

- TSLA Q4 deliveries disappoint; Antipodean currencies outperform.

Already a member? Sign in to unlock the full wrap

MARKET OVERVIEW

- SNAPSHOT: Stocks showed mixed performance, Treasury values declined, Crude oil prices decreased, the Dollar's value increased, and Gold prices rose.

- REAR VIEW: Japan's Prime Minister Takaichi may engage in discussions with U.S. President Trump, potentially meeting in the spring. Tensions between Iran and the U.S. are escalating. OPEC+ is anticipated to maintain current output levels at their upcoming meeting. TSLA's delivery figures fell short of expectations. Airbus is upholding its delivery target for 2025.

- WEEK AHEAD: Key events include jobs data from the U.S. and Canada, ISM PMIs, inflation figures from the Eurozone and China, and the potential selection of a new Fed Chair. The report can be downloaded by clicking here.

- CENTRAL BANK WEEKLY: A preview of the Fed Chair nominee and SNB Minutes, along with a review of the FOMC Minutes. The report can be downloaded by clicking here.

- WEEKLY US EARNINGS ESTIMATES: A relatively light earnings calendar, with STZ and JEF as notable highlights. The report can be downloaded by clicking here.

For more Newsquawk updates:

- Subscribe to receive free premarket movers reports.

- Try Newsquawk's premium real-time audio news service for 7 days.

MARKET WRAP

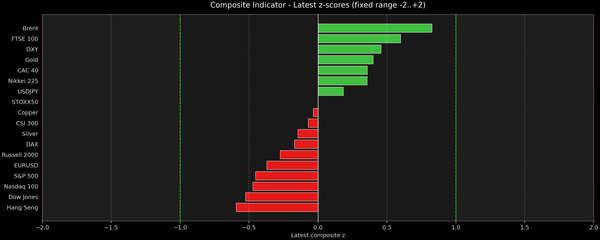

The first trading day of 2026 saw mixed results for stocks, with the Nasdaq underperforming after initially leading gains. Most sectors experienced gains, with Energy, Industrials, and Materials showing the strongest performance. Consumer Discretionary, Communication Services, and Consumer Staples lagged, while the Tech sector remained relatively unchanged. Tesla (TSLA) led the decline in Consumer Discretionary due to disappointing Q4 delivery numbers. In FX markets, antipodean currencies outperformed, tracking increases in base metals, while the Dollar saw slight gains and the Euro underperformed. The Eurozone PMI numbers received limited market reaction. T-Notes experienced a bear steepening ahead of a busy week, with attention focused on the NFP report and the potential appointment of a new Fed Chair, as well as the ISM Manufacturing and Services PMIs. Oil prices settled slightly lower on Friday amid limited news, as concerns about oversupply outweighed geopolitical factors ahead of the OPEC+ meeting on Sunday.

FIXED INCOME

T-NOTE FUTURES (H6) SETTLED 7+ TICKS LOWER AT 112-06+

T-Notes experienced a bear steepening in anticipation of a key week featuring the US NFP report and the potential selection of a successor to Fed Chair Powell. At settlement, the 2-year yield increased by 0.8bps to 3.477%, the 3-year yield rose by 2.1bps to 3.547%, the 5-year yield increased by 2.8bps to 3.739%, the 7-year yield rose by 3.0bps to 3.854%, the 10-year yield increased by 4.1bps to 4.191%, the 20-year yield rose by 3.8bps to 4.813%, and the 30-year yield increased by 3.5bps to 4.865%.

THE DAY: USTs declined across the curve on the first trading day of 2026 in quiet trading. The only data released was the final US S&P Global manufacturing PMI, which remained at 51.8, despite forecasts of an increase to 52.2, resulting in little reaction in T-Notes. Next week could see volatility with the potential Fed Chair pick, whereby the odds of Hassett taking the helm have eased to just 42%, with Warsh not far behind at 34%, followed by 13% for Waller. The December jobs report next Friday will influence expectations for Fed rate cuts in 2026, with over 50bps of easing currently priced in. This suggests a greater easing than the Fed's median projection of just one rate cut this year, with markets anticipating a more dovish Fed chair. However, views on the Fed are varied - the 2026 dot plots see rates ending the year in a vast range, between 2.00-2.25% at the low end, and 3.75-4.00% at the high end, vs. the current 3.50-3.75% rates. Also, next week, participants will be eyeing a return of corporate issuance with the New Year underway and with the holidays behind us.

STIRS/OPERATIONS

- Market Implied Fed Rate Cut Pricing: January 3bps, March 12bps, April 18bps, December 56.5bps

- NY Fed RRP op demand at USD 5.67bln (prev. 106bln) across 7 counterparties (prev. 49)

- EFFR at 3.64% (prev. 3.64%), volumes at USD 74bln (prev. 87bln) on December 31st.

- SOFR at 3.87% (prev. 3.71%), volumes at USD 3.458tln (prev. 3.321tln) on December 31st.

CRUDE

WTI (G6) SETTLED USD 0.10 LOWER AT 57.32/BBL; BRENT (H6) SETTLED USD 0.10 LOWER AT 60.75/BBL

The crude complex experienced a slight decline on Friday amid a light news day, as oversupply concerns outweighed geopolitical worries. Regarding the latter, US President Trump posted on Truth that, "If Iran shoots and violently kills peaceful protesters, the US will come to their rescue. We are locked and loaded and ready to go”. Following this, Iranian Parliamentary speaker remarked US bases and forces within the region are "legitimate targets", if the US was to "adventure". Little move was seen in the energy space, but continues to highlight the ongoing tensions seen. On the supply side, Reuters citing source reports, said that OPEC+ is expected to maintain its output conditions at the 4th of January confab. As a brief reminder, Bloomberg sources said that the group is expected to reaffirm its production pause through Q1, maintaining the halt to further supply increases, and the stance reflects concerns over a looming global oversupply backdrop, with crude prices sharply lower over 2025 and forecasters warning of a potential glut in 2026. WTI traded between USD 56.60-57.93/bbl and Brent USD 60.01-61.38, ahead of a busier calendar next week.

EQUITIES

CLOSES: SPX +0.15% at 6,856, NDX -0.17% at 25,206, DJI +0.62% at 48,363, RUT +0.96% at 2,506.

SECTORS: Energy +2.08%, Industrials +1.88%, Materials +1.51%, Utilities +1.19%, Health +0.44%, Financials +0.22%, Real Estate +0.05%, Technology +0.05%, Consumer Staples -0.16%, Communication Services -0.38%, Consumer Discretionary -1.14%.

EUROPEAN CLOSES: Euro Stoxx 50 +1.03% at 5,851, Dax 40 +0.14% at 24,524, FTSE 100 +0.20% at 9,951, CAC 40 +0.56% at 8,195, FTSE MIB +0.96% at 45,374, IBEX 35 +1.07% at 17,492, PSI +1.66% at 8,400, SMI +0.20% at 13,267, AEX +1.71% at 968.

STOCK SPECIFICS:

- Tesla (TSLA): Reported Q4 delivery numbers, where deliveries and production fell short of expectations.

- Ironwood Pharmaceuticals (IRWD): Stellar FY26 rev. guidance.

- Baidu (BIDU): Plans to spinoff AI chip unit.

- RH (RH), Wayfair (W), Williams-Sonoma (WSM): Trump decided to delay a 30% tariff hike on upholstered furniture.

- TSMC (TSM): US granted Co. an annual licence to import US chipmaking equipment to its Nanjing plant in China for ‘26.

- NVIDIA (NVDA): Seeking TSMC (TSM) support to boost H200 chip output after Chinese firms ordered over 2mln units for 2026, exceeding Nvidia’s 700k inventory, Reuters reports, citing sources.

US FX WRAP

The Dollar Index experienced marginal gains on Friday amid a typically quiet news environment, as market participants returned after the Christmas holidays. The US S&P Global Manufacturing PMI was a key data point, remaining unrevised at 51.8 but falling short of the expected 52.2. While the day was quiet, the economic calendar picks up next week with highlights including ISM Mfg., ADP, JOLTS, UoM and NFP.

G10 FX saw mixed performance against the Greenback in thin, headline-driven trading. EUR/USD traded within a narrow 1.1712-1765 range and saw muted reaction to the final European PMIs. Similarly, the Pound and CAD saw little movement, despite the UK S&P Global Manufacturing PMI being surprisingly revised lower, while the Canadian metric was lifted from the initial, but not as much as Wall St. forecasted. Cable traded between 1.3435-1.3502, and USD/CAD 1.3700-48.

Antipodean currencies outperformed, supported by broader risk sentiment and strength in metals. AUD/USD and NZD/USD traded within thin parameters, as traders await Aussie CPI next week.

JPY held flat within a narrow 156.56–157.00 band, with price action subdued after a volatile 2025 marked by political and fiscal uncertainty, BoJ tightening bias, and haven flows.