Market Wrap 2026-01-05

Today's US Market Wrap — Key Points

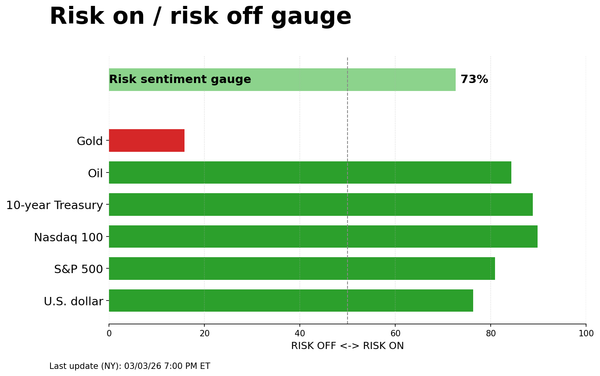

- Stocks, oil, and gold rise amid geopolitical tensions and mixed US data.

- US action in Venezuela sparks international condemnation and market volatility.

- Focus shifts to upcoming US jobs report and potential Fed Chair announcement.

- ISM Manufacturing PMI disappoints, while new orders and employment rise slightly.

Already a member? Sign in to unlock the full wrap

- MARKET SUMMARY: Stocks advanced, Treasury notes gained, crude oil increased, the dollar weakened, and gold rose.

- PREVIOUS SESSION RECAP: The US apprehended Venezuelan President Maduro, citing narco-terrorism. President Trump suggested a possible operation in Colombia. China and Russia condemned the US actions. The ISM Manufacturing PMI unexpectedly declined. Fed's Kashkari stated they are nearing a neutral stance. Fed's Paulson indicated further adjustments to the Federal Funds Rate are likely later in the year. OPEC+ agreed to maintain output levels as anticipated on Sunday. The Chinese Services PMI met expectations.

- UPCOMING EVENTS: Data releases include French CPI Prelim (Dec), German CPI Prelim (Dec), and US S&P PMI Final (Dec). Speakers include ECB's Cipollone and Fed's Barkin. Events include the release of Fed Discount Rate Minutes. Supply announcements are expected from Japan, Germany, and the US.

- WEEK AHEAD: Key events include US and Canada jobs reports, ISM PMIs, Eurozone and Chinese Inflation data, and potential news regarding the Fed Chair selection.

- CENTRAL BANK WEEKLY: A preview of the Fed Chair Nominee and SNB Minutes, along with a review of the FOMC Minutes, is scheduled.

- WEEKLY US EARNINGS ESTIMATES: A light earnings calendar is anticipated, with STZ and JEF as notable highlights.

More information is available via:

- Subscription to premarket movers reports

- Trial of a real-time audio news service for 7 days

MARKET WRAP

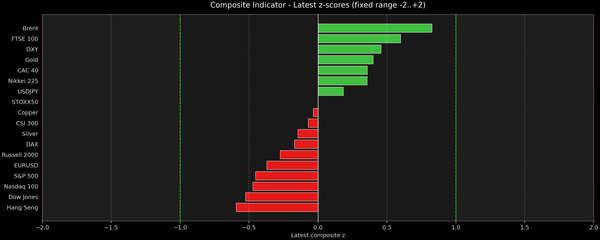

US indices closed higher, with Energy stocks outperforming due to strength in US oil companies following the US action in Venezuela, which resulted in Maduro's capture. WTI and Brent crude prices also increased. Despite volatility during the European session, the US session saw consistent upward movement. The US action in Venezuela has raised questions about potential operations in other countries, with President Trump making strong statements regarding Colombia. Chinese, Mexican, Turkish, and Russian officials all condemned the US actions in Venezuela. Most sectors experienced gains, with Utilities, Health, and Consumer Staples lagging. In FX markets, the Dollar Index reversed overnight gains as an unexpected decline in the ISM Manufacturing PMI offset strength stemming from the US capture of Maduro. Geopolitical developments sustained haven demand, initially supporting the dollar, but Antipodean currencies, GBP, and JPY ultimately saw strong gains, while CAD underperformed. Regarding the ISM report, although the headline figure disappointed and prices paid exceeded expectations, the new orders and employment sub-indices both increased, though remaining below 50. Treasury yields decreased across the curve, while spot gold and silver saw significant gains, with silver up approximately 7%. Fed's Kashkari (2026 voter) commented that he believes they are close to a neutral policy stance. Geopolitical factors are dominating market sentiment to begin the week and are likely to continue to do so. The US jobs report is due on Friday.

US

ISM MANUFACTURING PMI: The headline manufacturing PMI decreased to 47.9 from 48.2, falling short of the expected 48.4 and marking the lowest reading of 2025. Within the report, new orders edged up to 47.7 from 47.4, while the production index fell 0.4 points to 51. The backlog of orders index rose to 45.8 from 44.0 in November. Employment increased to 44.9 from 44.0, while prices paid were unchanged at 58.5, despite forecasts for a decline to 57.0. The report indicated that US manufacturing activity contracted at a faster pace in December, with declines in the production and inventories indices driving the 0.3-point fall in the headline. It was noted that the contraction in these two subindexes continues the short-term 'bubble' of improvement seen in recent PMI data and is a hallmark of ongoing economic uncertainty in manufacturing. On prices, Pantheon Macroeconomics noted that the index remains well below the April peak of 69.8 and that price measures across other major manufacturing surveys point to underlying core inflation easing meaningfully by mid-2026, by which time the one-off boost to consumer prices from tariff pass-through should be largely complete, giving the Fed further scope to resume its easing cycle.

FED'S KASHKARI (2026 voter): Stated that the job market is clearly cooling, inflation remains too high, and there is a risk that the unemployment rate could increase. Regarding the neutral rate, he remarked that his guess is that they are close to neutral at the moment, acknowledging the wide range of views on this matter within the Fed. The Minneapolis President expects the economy to remain resilient and, speaking on Fed independence, noted he is not concerned about the risk of Fed Bank Presidents being fired and disagrees with US Treasury Secretary Bessent that Bank Presidents do not represent their districts well.

FED’S PAULSON (2026 voter) said she anticipates inflation moderating, the labour market stabilising, and growth around 2% this year. She added that if these conditions are met, further adjustments to the Fed Funds Rate would likely be appropriate later in the year. Paulson views the current level of rates as still restrictive and sees a decent chance that they will end the year with inflation close to 2% on a run-rate basis, as tariff-related price adjustments will likely be completed. Furthermore, she stated that while the labour market is bending, it is not breaking and that the baseline outlook for the economy is pretty benign.

FIXED INCOME

T-NOTE FUTURES (H6) SETTLED 7 TICKS HIGHER AT 112-13+

T-notes settled firmer after soft ISM data in two-way trade. At settlement, 2-year yields decreased by 2.5bps to 3.457%, 3-year yields decreased by 3.1bps to 3.525%, 5-year yields decreased by 4.2bps to 3.71%, 7-year yields decreased by 4.1bps to 3.924%, 10-year yields decreased by 3.1bps to 4.163%, 20-year yields decreased by 3.3bps to 4.793%, and 30-year yields decreased by 2.4bps to 4.852%.

THE DAY: T-notes fluctuated overnight and in the morning but experienced some downward pressure during the start of the US session, coinciding with corporate issuance updates and commentary from Fed's Kashkari. He noted the tensions between the Fed's mandate, highlighting that the job market is clearly cooling and inflation is still too high, and suggested that they are close to neutral at the moment. Approximately 20 firms were expected to enter the corporate issuance market following the Christmas/New Year break. Attention then shifted to the ISM Manufacturing PMI report, which was softer than expected, causing T-notes to move higher. The downside to the headline was led by the production and inventories index, while prices paid were unchanged, and employment rose. Attention is largely focused on labour market data this week and the potential announcement from President Trump regarding who will replace Fed Chair Powell.

Over the weekend, the US captured Venezuela's Maduro and arrested him in the US, essentially taking the lead of Venezuela for now. The move initially caused weakness in oil due to Venezuela's substantial oil reserves, but this has since been pared, with crude settling well in the green. Treasury traders will be monitoring the inflationary impact of oil prices.

SUPPLY

- US sold USD 86bln of 3-month bills at a high-rate of 3.540%, B/C 2.84x

- US sold USD 77bln of 6-month bills at a high-rate of 3.475%, B/C 3.28x

STIRS/OPERATIONS

- Market Implied Fed Rate Cut Pricing: January 3bps (previous 3bps), March 12bps (previous 12bps), April 18bps (previous 18bps), December 59bps (previous 56.5bps)

- NY Fed RRP op demand at USD 6.5bln (previous 5.7bln) across 17 counterparties (previous 7)

- EFFR at 3.64% (previous 3.64%), volumes at USD 92bln (previous 74bln) on January 2nd.

- SOFR at 3.75% (previous 3.87%), volumes at USD 3.508tln (previous 3.458tln) on January 2nd

CRUDE

WTI (G6) SETTLED USD 1.00 HIGHER AT 58.32/BBL; BRENT (H6) SETTLED USD 1.01 HIGHER AT 61.76/BBL

The crude complex was firmer, edging higher throughout the US Day after the US attack on Venezuela and Maduro's capture over the weekend. Prior to the US joining, WTI and Brent were choppy through the European session, and saw lows of USD 56.31/bbl and 59.75, respectively, which swiftly reversed as US players entered for the week to hit peaks of USD 58.51/bbl and 61.89. As expected, the US's capture of Venezuela’s Maduro over the weekend took the headlines and added further geopolitical doubt into the equation - US officials have repeatedly said it is not an attack on Venezuela or its people. Following the US operation, Chinese, Mexican, Turkish, and Russian officials all condemned the US’s actions on Venezuela. Elsewhere, it has opened up rhetoric that it could happen again with other nations, and only heightened after President Trump remarked, “it sounds good to him regarding whether there will be an operation on Colombia; Colombia is very sick as the country is being run by a sick man... but he won't be doing it very long”. Regarding Greenland, another potential target, Denmark's PM said if the US were to attack another NATO nation, then everything stops and believes Trump is serious about wanting to take over Greenland. Regarding the moves in oil, ING writes that the reaction following the US arrest of Maduro suggests the market is more focused on the potential for supply increases in the longer term than any short-term disruptions from a power transition. Some had anticipated a rise in oil prices following the weekend due to near-term uncertainty over flows.

EQUITIES

CLOSES : SPX +0.64% at 6,902, NDX +0.77% at 25,401, DJI +1.23% at 48,977, RUT +1.58% at 2,548

SECTORS: Utilities -1.16%, Consumer Staples -0.33%, Health -0.31%, Technology -0.15%, Real Estate +0.15%, Communication Services +0.73%, Industrials +1.14%, Materials +1.21%, Consumer Discretionary +1.93%, Financials +2.16%, Energy +2.67%.

EUROPEAN CLOSES : Euro Stoxx 50 +1.30% at 5,926, Dax 40 +1.29% at 24,856, FTSE 100 +0.54% at 10,005, CAC 40 +0.20% at 8,212, FTSE MIB +1.04% at 45,847, IBEX 35 +0.70% at 17,614, PSI +0.82% at 8,470, SMI -0.24% at 13,235, AEX +1.81% at 985.

STOCK SPECIFICS:

- US President Trump stated US oil companies would move into Venezuela, restore production, and sell oil internationally, following the US capture of Maduro. This is relevant for Chevron (CVX), Exxon Mobil (XOM), and Haliburton (HAL).

- Goldman Sachs raised the price target on TSMC (TSM) to TWD 2,330 (previous 1,720) and maintained a ‘Buy’ rating, citing strong AI-driven growth.

- ASML (ASML) was upgraded at Bernstein to 'Outperform' from 'Market Perform'

- An Apollo-backed investor group will invest > USD 1bln in QXO (QXO).

- Mobileye (MBLY) secured a major US automaker as a customer for its next-gen chip, lifting production outlook.

- Duolingo (DUOL) was upgraded at BofA to 'Buy' from 'Neutral'

- Estee Lauder (EL) was double upgraded at Raymond James to 'Strong Buy' from 'Market Perform' with a PT of USD 130 and added shares to the firm's Analyst Current Favourites list.

- Coinbase (COIN) was upgraded at Goldman Sachs to 'Buy' from 'Neutral'.

- The US DoE announced USD 2.7bln to strengthen American uranium enrichment

FX

The Dollar Index erased gains seen overnight as an unexpected drop in the ISM Manufacturing PMI offset strength in response to the US capture of Venezuelan President Maduro. The geopolitical developments kept haven demand in play, originally supporting USD, with the dollar's liquidity likely another supporting factor. That said, ISM Mfg PMI printed 47.9 (exp. 48.4, prev. 48.2), albeit a jump in Employment and New Orders was present. US equities were untouched by geopolitics, while US treasuries caught a bid before extending on the ISM miss, leaving US yields lower across the curve. Ahead, geopolitics is likely to be the main focus, with countries scrambling for further details given the surprise nature of the attack/capture. Additionally, US relations between Colombia and Greenland will now be scrutinised, given that US President Trump floated an operation on the former and has exhibited interest in the latter. Separately, US data due this week includes ISM Services PMI and NFP. DXY hit before moving to highs of 98.861 before trading around lows of 98.27 into APAC trade

Sterling, NZD, JPY, and AUD strengthened vs USD while EUR and CHF eked out marginal strength. For Antipodes, the rally in metals supported strength, while Sterling was buoyed by the BoE's Consumer Credit rising well above expectations in November to GBP 2.077bln (exp. 1.1).

CAD was the notable underperformer to start the week, as desks note Canada's oil market may face downside risks from the potential reintroduction of Venezuela's oil reserves. Desks highlight the lack of competition to Canada's heavy crude and its reliance on exports to the US, but if Venezuela's reserves were to be unlocked, economic pressure may follow, given that the US is the most dependent on heavy crude it has ever been. USD/CAD remains firmer at ~1.3760, but off the 1.3812 highs.

EMFX: Latam currencies performed well against USD, as said ISM-induced weakness left COP, BRL, and CLP all firmer despite original weakness on geopolitical concerns.

More

markets stories