Market Wrap 2026-01-13

- European stock markets are exhibiting caution, while US stock futures are showing slight declines as markets await the US Consumer Price Index (CPI) data.

- The US Dollar Index (DXY) is relatively unchanged to slightly higher. USD/JPY briefly exceeded 159.00 following comments from Takaichi regarding a potential snap election. The Yen experienced some modest strengthening overnight after Finance Minister Katayama stated that US Treasury Secretary Bessent shares concerns about the Yen's weakness.

- Asia-Pacific (APAC) trading displayed a bearish sentiment, influenced by Japanese Government Bonds (JGBs). German Bunds are facing mild pressure due to a weak Bobl auction.

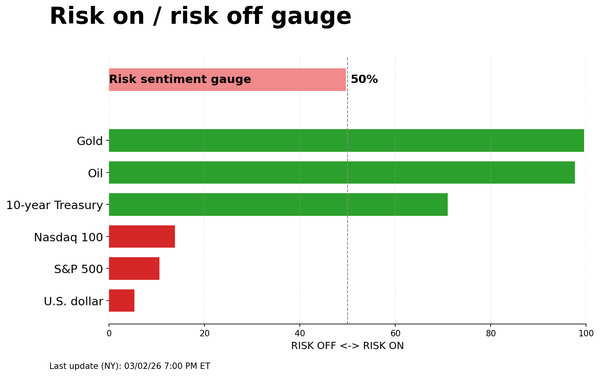

- Spot gold is trading slightly lower as investors await the US CPI data. Crude oil prices are rising amid an incident involving a tanker in the Black Sea and continued focus on Iran.

- Upcoming events include the US NFIB Small Business Optimism Index (December), US CPI (December), Average Weekly Preliminary Estimate from ADP, EIA Short-Term Energy Outlook (STEO), and speeches from Federal Reserve officials Barkin and Musalem. There will also be supply from the US.

EUROPEAN TRADE

EQUITIES

- European equities (STOXX 600 -0.2%) have traded cautiously throughout the morning session, as market participants await the CPI release. The AEX (+0.4%) is the top-performing index in the region, driven by gains in ASML (+1.2%) after Jefferies increased the company's price target, thereby supporting the index.

- European sectors are showing mixed performance, with Energy (+0.9%), Technology (+0.6%), and Banks (+0.6%) leading the gains. The Energy sector has benefited from higher crude oil prices due to increased geopolitical tensions between the US and Iran, while ASML's performance is boosting the Technology sector. On the downside, Autos (-0.7%), Utilities (-0.7%), and Construction & Materials (-2.6%) are lagging. The Construction & Materials sector is facing significant losses due to Sika (-7.0%) after the company's FY25 sales fell by 4.8%, with continued weakness in the Chinese market.

- US equity futures (ES -0.2% NQ -0.3% RTY -0.3%) are generally declining as markets await the US CPI data. Attention has been drawn to Trump's call for Microsoft to make changes to reduce data center power costs for US citizens.

FX

- The DXY is flat, trading within a narrow range of 98.89 to 99.03. The day's high is slightly below its 50-day moving average (DMA), while a downward move could test its 200 DMA at 98.80. The focus for the index today will be on the US CPI data. The consensus expects headline CPI to rise by 0.3% month-over-month (M/M) in December (previous 0.3%), with the annual rate remaining unchanged at 2.7% year-over-year (Y/Y). Goldman Sachs anticipates the figures to exceed consensus, citing firmer food and energy prices.

- Outside of the US, G10 currencies are mixed, with mild strength in the GBP, while the JPY is the clear underperformer. Other currencies are nearly flat against the USD. There is no specific factor driving the strength in the GBP this morning, while the JPY is facing multiple factors.

- USD/JPY surpassed 159.00 for the first time since July 11, 2024. Japan intervened twice on July 11 and 12 to bring the USD/JPY below the 160.00 level. The recent depreciation in the JPY has been driven by continued reports of PM Takaichi's plans to call an election, with the aim of securing a single-party government to enact more expansionary fiscal policy.

FIXED INCOME

- JGBs led the decline overnight as the "Takaichi trade" resumed.

- USTs and Bunds also experienced declines. USTs are down by a few ticks, holding above the 112-00 mark and yesterday's low. Focus is on the US CPI data later, where consensus expects the headline M/M and Y/Y prints to remain at 0.3% and 2.7%, while both core figures are expected to be higher by a tenth at 0.3% and 2.7%, respectively. Goldman Sachs anticipates a hotter print driven by technical factors.

- Bunds are at a low of 127.84, down by a maximum of 28 ticks. Bunds reached fresh lows following a weak Bobl auction, which had a weak bid-to-cover ratio and a lower-than-expected amount sold. Overall, market activity today will likely be influenced by the US CPI data. If the bearish trend continues, support levels to watch are 127.89, 127.82, and 127.70 from the last three sessions.

- Gilts gapped lower by 14 ticks at the open, reflecting the bearish sentiment from APAC trading, before falling further to a base of 92.30. Since then, the benchmark has recovered to opening levels. There was no reaction to the passing of inflation-linked (I/L) supply or the interview with Bank of England (BoE) Governor Bailey this morning, but the text will not be published until January 16th.

- Greece is beginning the sale of a new 10-year bond, with guidance seen at +60-65bps to mid-swaps.

- Italy sold EUR 4 billion of its 2.40% 2029 BTP, compared to an expected EUR 3.5-4 billion: average yield 2.48%, bid-to-cover ratio 1.45x.

- Germany sold EUR 4.597 billion of its 2.50% 2031 Bobl, compared to an expected EUR 6 billion: Average yield: 2.47%, bid-to-cover ratio 1.41x, retention 23.38%.

COMMODITIES

- Crude oil prices are firmer, with geopolitics in focus. Overnight activity was relatively range-bound, with no significant escalation or development. However, there were reports that President Trump was briefed on military and covert operations against Iran, but no decision has been made.

- As participants digest this risk and reports that two tankers were attacked near the Black Sea loading terminal for the CPC, crude oil has risen, posting gains exceeding USD 1.00/bbl. WTI reached highs of USD 60.82/bbl, and Brent reached highs of USD 65.20/bbl.

- Spot gold is slightly lower this morning, taking a breather after the strength seen in the previous session, where it reached fresh all-time highs beyond USD 4.6k/oz. There is slight pressure today without a clear driver, potentially profit-taking ahead of the US CPI data. Price action in Europe has been sideways, within a USD 4,573.87-4,608.13/oz range.

- There is some divergence between gold and silver this morning, with silver posting modest gains and currently holding at the upper end of the day's range, last at USD 85.76/oz.

- Base metals are mixed after choppy trading overnight. 3M LME Copper is currently trading within a USD 13,034-13,232/t range. Concerns have been raised among traders that copper may sharply pull back if demand slows in 2026, particularly if China curbs spending.

- Citi said its 3-month price target for gold and silver is now USD 5000/oz and USD 100/oz, respectively.

- Two oil tankers were attacked near the Black Sea loading terminal for the CPC, according to Bloomberg, citing sources. Two additional oil tankers have been hit near the Black Sea CPC terminal by drones, according to sources, bringing the total on Tuesday to four tankers.

TRADE/TARIFFS

- China's Commerce Ministry outlined the final ruling on the imports of solar polysilicon from the US and South Korea, effective January 14, with tariffs of up to 113.8%. Anti-dumping tariffs will continue to be collected for another five years.

- China said it opposes unilateral sanctions and "long-arm jurisdiction," following the 25% tariff on US trade for countries doing business with Iran.

- Taiwan officials said 'some' consensus has been reached with the US on a trade deal.

- Japanese Finance Minister Katayama said there were some detailed proposals on rare earth supply chains during the meeting with the US. A potential price floor on rare earths was discussed.

- US President Trump said any countries doing business with Iran are to pay a 25% tariff on any or all business being done with the US.

NOTABLE EUROPEAN DATA RECAP

- French Budget Balance (Nov) -155.4B vs. Exp. -165.0B (Prev. -136.2B, Rev. -136.2B).

- UK BRC Retail Sales YY (Dec) 1.0% (Prev. 1.2%).

CENTRAL BANKS

- Fed's Williams (Voter, Neutral) said monetary policy is well-positioned amid a favorable outlook and that policy is now closer to neutral, well-positioned ahead of the January rate decision; he expects that the labor market will stabilize this year. Regarding monetary policy, he stated that the Committee will carefully assess incoming data, the evolving outlook, and the balance of risks when considering the extent and timing of additional adjustments. He added that monetary policy is now well-positioned to support the stabilization of the labor market and the return of inflation to the FOMC’s longer-run goal of 2 percent and that the actions taken by the FOMC have moved the modestly restrictive stance of monetary policy closer to neutral. On inflation, he noted that underlying inflation trends have been pretty favorable and that tariffs have been overwhelmingly borne by domestic businesses and consumers. He expects inflation will be just under 2-1/2 percent for this year as a whole, before reaching 2 percent in 2027 and anticipates inflation will peak at around 2-3/4 to 3 percent sometime during the first half of this year as the full effects of tariffs are felt. He also stated that medium- and longer-term expectations remain well within their pre-Covid ranges and that inflation expectations remain well anchored. On growth, he said that the economic outlook is favorable and expects the economy to grow above trend this year, with real GDP growth between 2-1/2 and 2-3/4 percent. He added that GDP growth looks to have been somewhat above 2 percent last year, and it will likely pick up some this year. Regarding the labor market, he noted that this has been a gradual process, without signs of a sharp rise in layoffs, that downside risks to employment have increased as the labor market cooled, that the unemployment rate moved up and ended the year at 4.4 percent, and that he expects the labor market will stabilize this year and then strengthen somewhat thereafter.

- Fed's Williams (Voter, Neutral) said the Fed is not under strong influence to change rates. He expects the next Fed chair to understand the gravity of the role and that strong productivity growth echoes past booms. He added that the best way to instill confidence in the Fed is to do the job well. He expects improved labor market demand and is confident the Fed will return inflation to 2%. He noted that the jobs market is unusual with low hiring and low firing.

- Japan's government is reportedly likely to delay the nomination of a BoJ board member if PM Takaichi calls an election, according to Reuters, citing sources.

- Global central banks are reportedly drafting a statement in support of Fed Chair Powell.

NOTABLE US HEADLINES

- US President Trump is reportedly unhappy about AG Pam Bondi's performance and has repeatedly complained to aides, according to the WSJ, citing sources.

- US NFIB Business Optimism Index (Dec) 99.5 vs. Exp. 99.5 (Prev. 99.0)

NOTABLE US EQUITY HEADLINES

- Google (GOOGL) is reportedly set to develop and make high-end phones in Vietnam in 2026, as the company aims to move supply chains away from China, according to Nikkei Asia.

- Boeing (BA) said Aviation Capital Group has finalized a new order for 50 737 MAX jets.

- Microsoft (MSFT) President Smith warns that China is winning the AI race as China combines low-cost "open" models with hefty state subsidies.

- NVIDIA (NVDA) said they do not require upfront payment and would never require customers to pay for products they do not receive.

- US President Trump posted "I never want Americans to pay higher Electricity bills because of Data Centers", said Microsoft (MSFT) will make a major change this week to make sure Americans do not "pick up the tab" for their power consumption.

- AbbVie (ABBV) has signed an agreement with the Trump administration, securing a tariff exemption.

- Crown Castle (CCI) sues DISH Wireless over USD 3.5 billion default.

- Wayfair (W) partners with Google (GOOGL) to advance AI-powered shopping for the home.

GEOPOLITICS

RUSSIA-UKRAINE

- A push by French President Macron and Italian PM Meloni to begin discussions with the Russian Kremlin is gaining traction in EU capitals and in Brussels itself, Politico reported, citing sources. The primary goal is to ensure EU red lines are not crossed and to signal to the US that the EU has leverage. Elsewhere, the creation of the role of EU special envoy to Ukraine has the support of the Council and leaders. Mario Draghi and Alexander Stubb have been touted. However, EU diplomat Kallas opposes the role.

- Kyiv Mayor said the Russians are attacking the capital with ballistic missiles and that explosions are being heard.

MIDDLE EAST

- US President Trump is leaning towards striking Iran to punish the regime for killing protesters but hasn't made a final decision and is exploring Iranian proposals for negotiations, a White House official with direct knowledge told Axios.

- Iran's Foreign Minister said Tehran is ready for any action by the US, including military action.

- China said it opposes unilateral sanctions and "long-arm jurisdiction," following the 25% tariff on US trade for countries doing business with Iran.

- US President Trump has been briefed on a range of military and covert options against Iran, according to CBS News; however, no final decision has been made, and diplomatic channels remain open.

- "EU intends to impose new sanctions on Iran," Sky News Arabia reported.

- "Washington called on Dual U.S.-Iranian Citizens to Leave Iran," Al Arabiya reported.

- US President Trump said any countries doing business with Iran are to pay a 25% tariff on any or all business being done with the US.

- US President Trump is leaning towards striking Iran to punish the regime for killing protesters but hasn't made a final decision and is exploring Iranian proposals for negotiations, a White House official with direct knowledge told Axios.

- Iranian authorities claim that the situation is 'under control'.

- "EU intends to impose new sanctions on Iran," Sky News Arabia reported.

- US President Trump has been briefed on a range of military and covert options against Iran, according to CBS News; however, no final decision has been made, and diplomatic channels remain open.

- "Washington called on Dual U.S.-Iranian Citizens to Leave Iran," Al Arabiya reported.

- At least two unsanctioned supertankers are departing Venezuelan waters carrying crude oil, according to reports citing TankerTrackers.

- US Treasury Secretary Bessent posted that he was pleased to hear a strong, shared desire to quickly address key vulnerabilities in critical minerals supply chains; "I am optimistic that nations will pursue prudent derisking over decoupling".

CRYPTO

- Bitcoin is on a slightly firmer footing this morning and trades around USD 92k, while Ethereum posts gains to a slightly lesser magnitude.

- Punchbowl's Pederson writes that "we obtained the latest discussion draft of crypto market structure legislation," and the bill was reportedly sent to the Democrats on Monday. As it stands, the section related to stablecoin yields remains blank.

APAC TRADE

- Asia-Pac stocks followed on from Monday’s gains, with equities mostly in the green.

- ASX 200 started the session on the front foot, +0.4%, before extending gains and currently trading just shy of session highs at 8835. With spot XAU trading near ATHs, this has aided sectors such as metals and mining (2.0%) to continue Monday’s gains.

- Nikkei 225 returned from its long weekend with a gap higher, resulting in the index opening with gains as much as 3.7% and forming new ATHs. This comes amid a weaker JPY and growing speculation of PM Takaichi dissolving parliament. Japanese media noted that the LDP was looking to capitalize on Takaichi's high approval ratings.

- KOSPI opened Tuesday’s trade at ATHs and oscillated at highs before peaking at 4681 and slightly paring back but remains comfortably in the green.

- Hang Seng and Shanghai Comp. opened in line with the broader sentiment, with the former surging higher, aided by gains in Gigadevice (3986 HK). The latter is the laggard across Asia-Pacific equities, trading with slight gains of 0.2%.

NOTABLE ASIA-PAC HEADLINES

- China examines foreign ETF trades after Jane Street India probe, Bloomberg reported.

- Japanese Finance Minister Katayama said she shared concerns with US Treasury Secretary Bessent over weak JPY.

NOTABLE APAC DATA RECAP

- Japanese Bank Lending YoY (Dec) Y/Y 4.4% vs. Exp. 4.1% (Prev. 4.2%).

- Japanese Current Account (Nov) 3.674tln vs Exp. 3.594tln (Prev. 2.834tln, Rev. 2.834tln).

- Australian Westpac Consumer Confidence Index (Jan) 92.9 vs. Exp. 97 (Prev. 94.5).

- Australian Westpac Consumer Confidence Change (Jan) -1.7% vs. Exp. 2.6% (Prev. -9.0%, Rev. -9%).

- New Zealand NZIER Capacity Utilization (Q4) 89.8% vs. Exp. 89.3% (Prev. 89.1%).

Japanese Defense Minister Koizumi said assessments are ongoing into the impact of China's decision to restrict exports to Japan of dual-use items for military purposes.