Market Wrap 2026-01-13

Today's US Market Wrap — Key Points

- Stocks rose amid mixed sector performance; financials lagged due to credit card fee cap proposal.

- Treasury yields steepened on Fed independence concerns and DOJ probe into Chair Powell.

- Dollar weakened; Antipodean currencies and GBP gained. Focus shifts to CPI and earnings.

Already a member? Sign in to unlock the full wrap

Market Summary

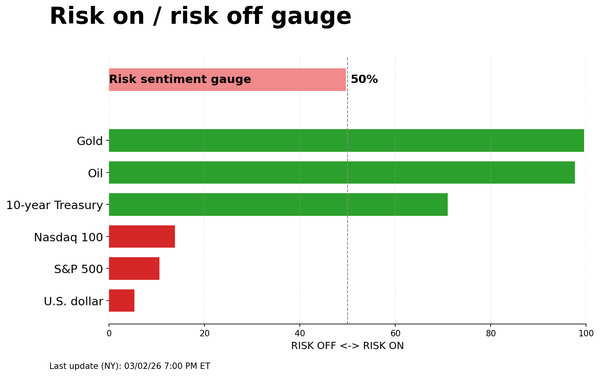

- SNAPSHOT: Stocks increased, Treasury yields steepened, Crude oil rose, the Dollar weakened, and Gold increased.

- REAR VIEW: The Department of Justice issued subpoenas to the Federal Reserve regarding the renovation of its Washington headquarters. Jerome Powell is expected to continue his role as Fed Chair. Donald Trump advocated for a one-year cap of 10% on credit card interest rates. Trump indicated the military is considering strong options regarding Iran. Iran's Foreign Minister and US Envoy Witkoff reportedly discussed a potential meeting. A US 3-year note auction was mediocre, while a US 10-year auction was strong. Apple plans to use Google's Gemini for its AI-powered Siri.

- COMING UP: Data releases include the US NFIB (December), CPI (December), and Average Weekly Preliminary Estimate ADP. Events include the EIA STEO. Speakers include the Bank of England's Bailey and Federal Reserve's Barkin and Musalem. Supply events are scheduled for Australia, the UK, Italy, Germany, and the US. Earnings reports are expected from JPMorgan, Delta Air, and Bank of New York Mellon.

- WEEK AHEAD: Key events include US Earnings, US CPI, US Retail Sales, UK GDP, and China Trade.

- WEEKLY US EARNINGS ESTIMATES: Financial institutions are beginning earnings season, with reports due from JPM, BAC, WFC, GS, MS, and C.

MARKET WRAP

Equities closed higher, gaining strength throughout the session and recovering from overnight weakness. The Russell 2000 performed well, while sector performance was mixed. Consumer Staples led gains, driven by Walmart's (WMT) inclusion in the Nasdaq 100 index. Financials underperformed due to Trump's proposal to cap credit card fees, impacting banks ahead of earnings. Focus was also on potential threats to Fed independence following the Department of Justice investigation into Fed Chair Powell regarding building renovation costs. This news weighed on the Dollar, and the Treasury curve steepened as long-end yields rose, reflecting increased term premium. Oil prices increased amid geopolitical developments and potential escalations between the US and Iran. The Dollar's decline and stock market recovery benefited Antipodean currencies and the British Pound, with Antipodean currencies also supported by rising metal prices. Despite the Dollar's weakness, the Yen lagged, continuing Friday's trend as reports suggested Prime Minister Takaichi's ruling LDP party plans to dissolve the Lower House.

FIXED INCOME

T-NOTE FUTURES (H6) SETTLED 2+ TICKS LOWER AT 112-04+

The Treasury curve bear steepened in response to the Department of Justice's probe into the Federal Reserve. At settlement, the 2-year yield increased by 0.3bps to 3.543%, the 3-year yield increased by 0.5bps to 3.599%, the 5-year yield increased by 0.7bps to 3.764%, the 7-year yield increased by 1.0bps to 3.965%, the 10-year yield increased by 1.6bps to 4.187%, the 20-year yield increased by 1.7bps to 4.783%, and the 30-year yield increased by 2.1bps to 4.840%.

THE DAY: T-Notes experienced a bear steepening on Monday, with long-end yields selling off due to the Department of Justice's investigation into Fed Chair Powell and renovation costs at the Fed building. While Fed Chair Powell typically disregards such matters, he responded to these allegations, denying them and asserting that they represent an attack from the administration on the Fed's interest rate policies. This perceived threat to Fed independence led to higher long-end yields as investors demanded more term premium, similar to the reaction seen when reports circulated about Hassett potentially becoming Fed Chair due to his close ties with President Trump. US Treasury Secretary Bessent reportedly expressed concern to Trump that the probe has created a "mess," and now believes that Fed Chair Powell could remain in his position until his term as governor expires in May 2028. This situation leaves Trump with only one Fed appointment this year, the replacement for Miran, who is likely to be the next Fed Chair. Trump is still scheduled to interview BlackRock's Rick Rieder for the Fed Chair role, with the interview reportedly taking place on Thursday, and an announcement on Trump's selection is expected by the end of the month. Meanwhile, T-Note supply had little impact on price action today, with the 30-year bond auction scheduled for Tuesday and traders also focusing on the US CPI data.

SUPPLY

Notes

- The US Treasury sold USD 39 billion of 10-year notes at a high yield of 4.173%, stopping through the When Issued by 0.7bps. This was a better sign of demand compared to the prior on-the-screws auction and better than the six-auction average of 0.1bps. The bid-to-cover ratio of 2.55x matched the prior and was slightly better than the 2.51x average. Direct demand rose to 24.5% from 21%, above the 20.6% average. Indirect demand was little changed at 69.6%, in line with recent averages. Dealers were left with a low 5.9% of the auction, a sign of stronger overall demand compared to the prior 8.8% and 9.9% average.

- The US Treasury sold USD 58 billion of 3-year notes at a high yield of 3.609%, stopping through the when-issued by 0.1bps. This was not as strong as the prior 0.8bps or the 0.4bps six-auction average. The bid-to-cover was more in line at 2.65x (previous 2.64x, average 2.65x). Direct demand rose to 29.5% from 19%, above the 24.6% average, but indirect demand fell to 56.5% from 72%, below the 63.3% average. Dealers were left with an above-average takedown of 14%, compared to the prior 9% and the 12% average.

- The US Treasury is scheduled to sell USD 22 billion of 30-year bonds on January 13th, with settlement on January 15th.

Bills

- The US sold USD 86 billion of 3-month bills at a high rate of 3.570%, with a bid-to-cover ratio of 2.79x.

- The US sold USD 79 billion of 6-month bills at a high rate of 3.490%, with a bid-to-cover ratio of 3.17x.

- The US is scheduled to sell USD 75 billion of 6-week bills on January 13th.

STIRS/OPERATIONS

- Market Implied Fed Rate Cut Pricing: January 0bps (previous 0bps), March 4.5bps (previous 7bps), April 10bps (previous 11bps), December 50bps (previous 50bps).

- The NY Fed RRP operation saw demand at USD 3.4 billion (previous 3.3 billion) across 11 counterparties (previous 6).

- The EFFR was at 3.64% (previous 3.64%), with volumes at USD 93 billion (previous 87 billion) on January 9th.

- The SOFR was at 3.64% (previous 3.64%), with volumes at USD 3.166 trillion (previous 3.249 trillion) on January 9th.

CRUDE

WTI (G6) SETTLED USD 0.38 HIGHER AT 59.50/BBL; BRENT (H6) SETTLED USD 0.53 HIGHER AT 63.87/BBL

Crude oil prices saw marginal gains amid heightened tensions between Iran and the US. Over the weekend, reports indicated that several hundred more Iranian protesters died, and Trump responded by stating that the US was considering "very strong options" to intervene, after previously warning that he would act if protesters were killed. More recent updates indicated that Iran's Foreign Minister and US Special Envoy Witkoff discussed a potential meeting soon, and the Wall Street Journal, citing US officials, reported that the White House is weighing Iran's nuclear talks offer as Trump leans towards strikes, although Vance is leading efforts by some aides to persuade Trump to engage in negotiations with Tehran. Despite ongoing geopolitical concerns, price action was relatively contained on Monday as participants await the next catalyst for the energy sector. Elsewhere, Interior Secretary Burgum stated that low oil prices would present an opportunity to fill the Strategic Petroleum Reserve (SPR), which helped oil prices rise into settlement.

EQUITIES

CLOSES: SPX +0.16% at 6.977, NDX +0.08% at 25,788, DJI +0.17% at 49,590, RUT +0.44% at 2,636

SECTORS: Consumer Staples +1.42%, Industrials +0.75%, Materials +0.74%, Technology +0.35%, Real Estate +0.23%, Utilities +0.19%, Health +0.07%, Consumer Discretionary +0.04%, Communication Services +0.02%, Energy -0.66%, Financials -0.80%

EUROPEAN CLOSES: Euro Stoxx 50 +0.32% at 6,017, Dax 40 +0.54% at 25,398, FTSE 100 +0.16% at 10,141, CAC 40 -0.04% at 8,359, FTSE MIB +0.03% at 45,732, IBEX 35 +0.14% at 17,674, PSI -0.31% at 8,494, SMI +0.02% at 13,425, AEX +0.54% at 994.

STOCK SPECIFICS:

- Trump is advocating for a one-year cap of 10% on credit card interest rates. This is relevant for Capital One Financial (COF), Synchrony Financial (SYF), JPMorgan (JPM), and Citigroup (C).

- Allegiant Travel (ALGT) is set to acquire Sun Country (SNCY) for USD 18.89 per share.

- Apple (AAPL) has chosen Alphabet's (GOOGL) Gemini for its AI-powered Siri, with the integration expected in 2026.

- Citi (C) is reportedly cutting approximately 1,000 jobs this week as part of a cost-cutting initiative.

- CrowdStrike (CRWD) was downgraded at KeyBanc from 'Overweight' to 'Sector Weight'.

- Duolingo (DUOL) announced a CFO transition, and preliminary Q4 results were disappointing.

- Exelixis (EXEL) FY26 revenue outlook missed expectations.

- Meta (META) reportedly plans to cut approximately 10% of its Reality Labs Business staff, according to the New York Times.

- Moderna's (MRNA) 2025 revenue outlook matched street estimates.

- Palantir (PLTR) was upgraded at Citi from 'Neutral' to 'Buy'.

- Shake Shack's (SHAK) preliminary Q4 revenue metric missed expectations.

- Snowflake (SNOW) was downgraded at Barclays from 'Overweight' to 'Equal Weight'.

- UnitedHealth (UNH) reportedly used aggressive tactics when collecting payment-boosting diagnoses for Medicaid Advantage members.

FX

The Dollar Index weakened, seemingly influenced by concerns over Federal Reserve independence due to the criminal investigation into Chair Powell regarding the Fed's renovation of its Washington headquarters. Powell responded strongly, but the outcome remains uncertain. News flow was relatively light on Monday, with no Fed speeches or data releases, as attention shifts to Tuesday's CPI data and the start of US earnings season. Geopolitical tensions remain a focus, particularly any escalation between the US and Iran, while Trump's after-hours comments on Friday targeting credit card interest rates may also be dampening the Dollar's appeal.

G10 currencies, excluding the Yen, strengthened against the weaker Dollar. The New Zealand Dollar outperformed, with NZD/USD reaching a high of 0.5769, supported by strength in the metals complex, where spot gold continued to reach new all-time highs. The British Pound, Swiss Franc, Australian Dollar, Euro, and Canadian Dollar also saw similar gains, with the Swiss Franc favored as a safe haven amid the Dollar's weakness. The Yen was hindered by continued reports of Prime Minister Takachi's plans to dissolve parliament and call a snap election. The Yen was the only G10 currency to lose ground against the Greenback, with USD/JPY reaching a peak of 158.21 versus a low of 157.52. FX headlines were limited as the Dollar's situation dominated, but on the central bank front, ECB's Villeroy stated that it is "fanciful" to think the ECB could raise key rates this year, and a decline in the Dollar is possible if Fed independence is challenged. EUR/USD traded between 1.1622 and 1.1698.

LatAm currencies generally benefited from the aforementioned Dollar weakness. There were few new specifics aside from what was mentioned above regarding the Dollar, although the Brazil Treasury projects gross debt-to-GDP at 83.6% in 2026, rising to 88.6% by 2032.