Market Wrap 2026-01-14

Today's US Market Wrap — Key Points

- Equities decline amid tech weakness; energy outperforms on crude gains.

- US data mixed; retail sales strong, PPI hotter. Geopolitical tensions ease.

- Dollar weakens; Yen strengthens on intervention and political news.

- Focus shifts to upcoming UK GDP, EZ trade data, and Fed speakers.

Already a member? Sign in to unlock the full wrap

MARKET WRAP

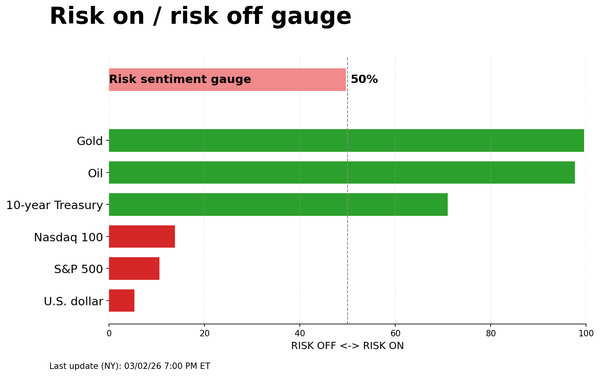

- SNAPSHOT: Equities decreased, Treasuries increased, Crude relinquished gains post settlement, Dollar decreased, Gold increased.

- REAR VIEW: Trump stated he was informed Iran will cease killings, with no plans for executions; US Retail Sales exceeded expectations in November, PPI in October & November was mixed; Investors expressed disappointment with US big bank earnings despite some beats; China's trade surplus increased in December, imports and exports surpassed expectations; China's stock exchanges will raise margin ratio; Japan's CDP and Komeito parties reportedly commenced talks on forming a new party; Further verbal intervention from Japan officials; China's customs reportedly informed customs agents that NVDA H200 chips are not permitted to enter China.

- COMING UP: Data: UK GDP Estimate (Nov), EZ Trade (Nov), US Export/Import Prices (Dec; Nov-cancelled), NY Fed (Jan), Weekly Claims (w/e 3rd Jan). Speakers: ECB's de Guindos; Fed's Bostic, Barr, Barkin, Schmid. Supply: Spain. Earnings: Morgan Stanley, Goldman Sachs, BlackRock.

More information:

- Subscribe to premarket reports

- Trial real-time audio news for 7 days

Indices predominantly closed lower on Wednesday, with heavy-cap tech stocks declining, leading indices lower. The Nasdaq underperformed, while the Russell and Equal Weight S&P closed higher. Sectors were mixed, with outperformance in Energy, Consumer Staples, and Real Estate, while Consumer Discretionary, Tech, and Communications lagged. Energy stocks outperformed, tracking crude prices higher for most of the day, with benchmarks settling in positive territory. However, futures erased gains post-settlement after Trump stated he was informed by an Iranian source that they will stop killings and there are no plans for execution, reducing the probability of a US attack on Iran. This news also impacted gold prices (which remained positive) and supported equity indices into the closing bell, as reports throughout the day suggested Trump could attack Iran within 24 hours, though these fears have now subsided. In FX, the Dollar lagged while the Yen outperformed. The Yen was supported by verbal intervention from officials and reports that the opposition parties - CDP and Komeito - have started talks on forming a new party. A new coalition may make it harder for Takaichi to secure a majority in the snap election, reducing the chance of her passing more expansive fiscal policy measures. Elsewhere, US data showed hot-leaning PPI reports for October and November, though monthly figures were more encouraging, and Retail Sales were generally stronger than expected. The data had little market reaction, with focus on geopolitical developments. The US and Denmark also spoke, but Denmark was unable to sway the US's view on Greenland. Regarding tech weakness, losses were broad-based, particularly within the heavyweights. China reportedly told customs agents that NVIDIA's (H200) AI chips are not allowed to enter the country, though it was unclear if this was a formal ban or a temporary measure. Meanwhile, The Information reported that TSMC (TSM) has not been able to supply customers like NVDA and Broadcom (AVGO) with the chips they need fast enough.

US

PPI: The BLS released the October and November PPI. The October PPI rose 0.1% M/M, with November rising 0.2% M/M, while the Y/Y October print rose 2.8%, with November rising 3.0%. The core metrics for November saw no change M/M after a 0.3% gain in October, but rose 3.0% Y/Y in November. Generally, both reports leaned hotter than expected, though some monthly figures were encouraging. Within the report, the PCE components generally leaned softer than October's, with Portfolio Management cooling to 1.44% from 3.75% and Passenger Airline Services declining 0.25%, vs the prior -0.06%. Home Health and Hospital outpatient care accelerated slightly, but inpatient care and nursing home care eased. Following the data, analysts at Pantheon Macroeconomics expect the core PCE deflator rose 0.25% in October and 0.19% in November, followed by a 0.37% increase in December - though the December forecast is based just on CPI data for now and is subject to revisions.

RETAIL SALES: US retail sales for November were stronger than expected, with the headline rising 0.6% (exp. 0.4%, prev. 0%), with Y/Y lifting 3.3% (exp. 3.0%, prev. 3.5%). Ex autos and ex gas/autos also surpassed expectations, coming in at 0.5% (exp. 0.4%, prev. 0.4%) and 0.4% (exp. 0.1%, prev. 0.5%), respectively. Retail control was as anticipated 0.4%, dipping from 0.8%. The strong gain in retail sales supported Oxford Economics forecast that this holiday season was a solid one for retailers, with the volume of holiday retail sales rising by the strongest since 2021. However, the consultancy adds that it rests on narrow foundations as spending is driven by high-income households spending part of their recent wealth gains. Looking ahead, OxEco suggests the data is consistent with its forecast for overall consumer spending to expand by close to 2% annualised in Q4, a slowdown driven mostly by the expiry of the EV tax credit that hit auto sales hard earlier in the quarter. One of the areas of weakness in the retail sales report is the housing-related categories, and while Oxford expect some recovery in housing demand this year, it is a sector of the economy that will continue to lag.

FED

PAULSON (2026 Voter) said that modest rate cuts are likely appropriate later this year if forecasts are met. She expects inflation to be around 2% by year-end, alongside growth of around 2%. She noted the job market is bending, but not breaking, while the baseline economic outlook is pretty benign. She is cautiously optimistic about inflation moving back to target and is seeking greater clarity this year on what is driving the jobs market.

KASHKARI (2026 voter): Speaking to the NYT, noted the Trump admin actions against the Fed are "really about monetary policy", and Powell explained that accurately. On monpol, Kashkari does not see any impetus for a rate cut in January, and with rates between 3.5-3.75%, that puts the Fed in a “pretty good spot right now”. The 2026 voter added that there could still be some scope to cut later in the year, but right now, it is “just way too soon”. The Minneapolis Fed President spoke again later, and noted the economy is confusing and the job market is showing signs of weakness, and inflation is still too high but moving in the right way. Back on monpol, he wonders how tight it actually is, and added that the job and inflation goals are in tension. Lastly, on the employment side of things, Kashkari is not sure what the current breakeven rate is for the job market.

BARKIN (2027 voter) : Said that no single meeting is decisive and that errors can be corrected at the next meeting. Barkin is not seeing a strong business push to pass on price hikes and described the CPI data as encouraging, but noted shelter inflation is still biased due to missing October data. Barkin added that tariffs still create some cost and inflation pressure over time, but the timing is unclear. He said inflation is higher than our target, but it doesn't seem to be accelerating just yet; unemployment has ticked up, but not ticking out of control.

GOOLSBEE (2027 voter): Did not say much but noted that central bank independence is key to low prices, and one thing he is looking for is whether the consumer is going to continue to be the driver of growth. On the other side of things, the Chicago Fed President remarked, “is there evidence that we’re kind of putting this spike up in prices behind us.”

GOVERNOR MIRAN (voter): Reiterated his calls for rate cuts. Noting deregulation should reduce pressure on prices, reiterating the need for 150bps of cuts this year. He noted inflation is coming down, and that "other stuff is just noise".

BOSTIC (Retiring) : Inflation is still quite far from where we need to be; those are not characteristics that suggest to him that a passive posture of policy is appropriate and that the Fed still needs to be restrictive. As they go through 2026, Bostic believes the economy is likely to get stronger and could put more upward pressure on prices, and that is something they have to watch. The Atlanta Fed President described the labour market as having weakened, but not clearly weak. Bostic added that they are in a difficult environment to see what might be coming in the economy and inflation. On dissents, he said not to expect there be 100% consensus on everything.

FIXED INCOME

T-NOTE FUTURES (H5) SETTLED 6+ TICKS AT 112-15

T-notes bull flattened on geopolitical developments and mixed US data. At settlement, 2-year −1.9bps at 3.518%, 3-year −3.1bps at 3.567%, 5-year −3.7bps at 3.719%, 7-year −3.9bps at 3.919%, 10-year −3.7bps at 4.415%, 20-year −4.5bps at 4.736%, 30-year −4.5bps at 4.794%.

THE DAY: T-notes rose gradually throughout the session, with upside led by the long-end to see the curve bull flatten. Rising geopolitical tensions supported the move amid haven demand. The tensions are most rife with Iran, with reports suggesting the US could strike within 24 hours, while several nations have urged citizens to leave Iran immediately. However, US President Trump later announced that he had been told that Iran is stopping the killing and there are no plans for executions, seeing oil prices tumble, wiping out gains; T-notes were little phased. Meanwhile, Denmark and the US met to discuss Greenland, but Denmark said they were not able to shift the stance of the US. Elsewhere, data was in focus; the October and November PPI were mixed, while analysts at Pantheon now expect a core PCE deflator of 0.25% in October and 0.19% in November, followed by a 0.37% increase in December, albeit that is based solely on CPI data for now. Meanwhile, Retail Sales were strong, beating expectations on headline and core, while control was in line with expectations. There were several Fed speakers today, too, with Miran reiterating dovish commentary, Paulson said further modest cuts are likely this year if forecasts are met, while Bostic said inflation is still quite far from where it needs to be, with Kashkari suggesting it is moving in the right direction, but is still too high.

SUPPLY

Bills

- US sold USD 69bln 17-week bills at a high rate of 3.560%, B/C 3.00x

- US to sell USD 95bln (prev. 80bln) of 4-week bills and USD 90bln (prev. 80bln) of 8-week bills on Jan 15th; to settle on Jan 20

STIRS/OPERATIONS

- Market Implied Fed Rate Cut Pricing: January 0bps (prev. 0bps), March 5.7bps (prev. 5bps), April 10.2bps (prev. 10bps), December 53.6bps (prev. 53bps)

- NY Fed RRP op demand at USD 3.2bln (prev. 3.3bln) across 15 counterparties (prev. 5)

- EFFR at 3.64% (prev. 3.64%), volumes at USD 92bln (prev. 93bln) on January 13th.

- SOFR at 3.65% (prev. 3.64%), volumes at USD 3.177tln (prev. 3.128tln) on January 13th

- Treasury Buyback (20-30 year, liquidity support, max USD 2bln): Accepts USD 2bln of USD 25bln offers, accepts 5 of 35 eligible issues. Offer-to-cover: 12.5x

CRUDE

WTI (G6) SETTLED USD 0.87 HIGHER AT 62.02/BBL; BRENT (H6) SETTLED USD 1.05 HIGHER AT USD 66.52/BBL

NOTE: After settlement, gains were erased, with prices now lower by over USD 1.00/bbl after Trump said he has been told by Iranian sources that the killings will stop with no plans for executions. The development means the likelihood of a US attack on Iran has been significantly reduced, given Trump's threat was based on his disapproval of the violence against protestors. Trump added he will watch and see what the process is and go from there.

The crude complex saw gains on Wednesday, with the bulk of the upside seen in the European morning on heightened Iran/US tensions. Overnight, WTI and Brent tilted lower, hitting lows of USD 60.39/bbl and 64.67/bbl, respectively, before reversing back higher as European players entered for the day, given the raft of geopolitical updates. To begin with, a senior Iranian official said that Tehran has warned regional nations that it will strike US bases in the region in the scenario that they are attacked by the US, which was swiftly followed by reports that some personnel have reportedly been told to leave Qatar's Al Udeid US airbase by Wednesday evening. Further supporting the upside, and pushing benchmarks to incremental fresh highs, was an IRGC official noting their missile stockpile has increased since June 2025, and is at its highest level of readiness to respond to any attack, once again showing Tehran is not backing down from the punchy rhetoric, yet. Nations are urging citizens to leave Iran immediately, while reports also warn of a US attack on Iran within 24 hours. It remains to be seen whether this is kinetic or non-kinetic.

While US/Iran dominated the tape, the latest OPEC MOMR saw 2026 world oil demand remain at 1.4mln BPD (unchanged from Dec MOMR), with 2027 world oil demand forecast to grow by 1.3mln BPD Y/Y. In the weekly EIA data, little move was seen, crude saw a surprise build, gasoline saw a much larger than expected build, and distillates saw a shallower than forecasted draw. Overall, crude production fell 58k W/W to 13.75mln.

EQUITIES

CLOSES : SPX -0.53% at 6,927, NDX -1.07% at 25,466, DJI -0.09% at 49,150, RUT -0.52% at 2,652

SECTORS: Consumer Discretionary -1.75%, Technology -1.45%, Communication Services -0.55%, Financials -0.20%, Materials -0.18%, Industrials +0.14%, Health +0.70%, Utilities +0.74%, Real Estate +1.08%, Consumer Staples +1.18%, Energy +2.26%.

EUROPEAN CLOSES : Euro Stoxx 50 -0.36% at 6,008, Dax 40 -0.53% at 25,286, FTSE 100 +0.46% at 10,184, CAC 40 -0.19% at 8,331, FTSE MIB +0.27% at 45,647, IBEX 35 +0.05% at 17,696, PSI +0.10% at 8,568, SMI +0.61% at 13,446, AEX -0.04% at 997.

STOCK SPECIFICS:

- US approved selling NVIDIA (NVDA) H200 AI chips to China, subject to sufficient US supply, security assurances & non-military use.

- China banned cybersecurity software from Fortinet (FTNT) and Palo Alto (PANW).

- Infosys (INFY): Rev. & op. margin missed, but FY rev. outlook impressed.

- Wells Fargo (WFC): Top & bottom line light

- Bank of America (BAC): EPS, rev., NII beat w/ provision for credit losses less than expected.

- Citigroup (C): Profit and revenue beat. Cannot support a credit card interest rate cap and such a cap would have a detrimental impact on the economy and restrict access to credit; CEO warned of more job cuts and calls time on ‘old, bad habits’; CFO expects NII ex markets to be up between 5-6% in 2026.

- Rivian Automotive (RIVN): Downgraded at UBS to 'Sell' from 'Neutral'.

- Tesla (TSLA) is struggling to offload about a third of the initial vehicles it imported to India last year, as some prospective buyers who made early bookings have backed out, Bloomberg reports, citing sources.

- OpenAI and Anthropic have taken early steps to undergo IPOs, NY Times reports; SpaceX said to interview banks regarding their IPO.

FX

The Dollar was little changed mid-week as lagging US data did little to spur a reaction across markets. Retail Sales topped expectations in November, while the US PPI was mixed across October and November. Elsewhere, big bank earnings were negatively received despite top and bottom line beats from Bank of America and Citigroup, a factor that likely weighed on USD. Lots of Fedspeak was heard with economic uncertainty voiced by Kashkari (2027 voter), while Paulson (2026 voter) believes modest cuts are likely appropriate later this year if forecasts are met. Also from the Fed, the Beige Book did little to bolster employment concerns as 8/12 districts reported no changes in hiring. Separately, geopolitical risk took a step back in late trade after Trump said he had been told killing in Iran is stopping, no plan for executions. This resulted in oil prices moving into the red as the likelihood of a US attack, kinetic or non-kinetic, has been reduced.

Yen was firmer, supported by jawboning from Japanese officials as well as reports that opposition parties (CDP and Komeito) have begun talks on forming a new party. On the former, Finance Minister Katayama said they will take appropriate action to deal with excessive FX moves, with top FX diplomat Mimura saying similar thereafter; modest JPY strength followed both comments. JPY strength on the political reports came given that both parties are “centrist”, and any success at nullifying an LDP majority will, in theory, scale back the implementation of expansionary fiscal policy from Takaichi.

G10 FX were generally firmer, albeit modestly against the dollar, with the EUR and AUD the laggards. Newsflow and data were light across the space, with remarks seen from policymakers. BoE's Taylor reiterated his view that policy is to normalise at neutral sooner rather than later. Meanwhile, ECB's de Guindos said inflation is in a good place.