Market Wrap 2026-01-15

Today's US Market Wrap — Key Points

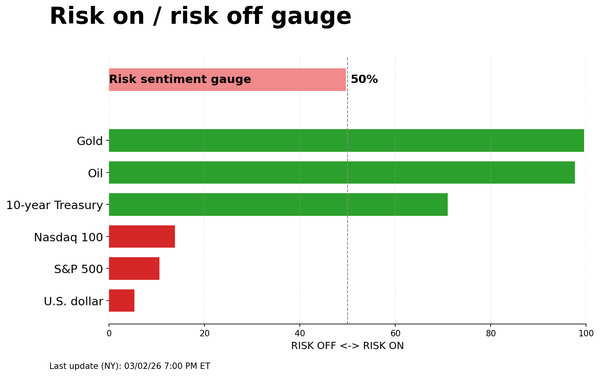

- Stocks rose, Treasuries fell, Dollar up, Oil & Gold down.

- Strong jobs data & Fed surveys support current rate stance.

- Earnings beat from TSMC boosts semis; GS, MS, BLK rally.

- Focus shifts to German CPI, US Industrial Production data.

- Crude oil weakens after Trump comments on Iran.

Already a member? Sign in to unlock the full wrap

- SNAPSHOT: Stocks increased, Treasury values decreased, Crude oil prices decreased, the Dollar's value increased, and Gold prices decreased.

- REAR VIEW: Initial jobless claims were strong; Regional Federal Reserve surveys were solid; President Trump stated that he was informed the killings in Iran are ceasing, and there are no plans for executions; TSMC's Q4 earnings beat boosted global semiconductor stocks; the US Treasury imposed sanctions on Iran; Federal Reserve's Schmid maintained a hawkish stance, while Barr described interest rates as being at the appropriate level; UK GDP exceeded expectations in November; the People's Bank of China (PBoC) reduced the 1-year relending facility rate; the Bank of Japan (BoJ) is reportedly likely to maintain steady interest rates in January; Morgan Stanley (MS), Goldman Sachs (GS), and BlackRock (BLK) rallied following their earnings reports.

- COMING UP: Data releases include the final German CPI for December and US Industrial Production for December. Speakers include the Bank of England's Bailey, and Federal Reserve members Collins, Jefferson, and Bowman. Supply data from Australia is expected. Earnings reports are due from State Street and PNC Financial Services.

MARKET WRAP

US indices experienced gains, although they receded from their highs during the US afternoon and into the close. An initially strong report from TSMC provided positive momentum to the technology sector and broader semiconductor stocks, but peak gains were not sustained. Despite the afternoon pullback, the technology sector remained strong, and most sectors showed an upward bias. Utilities and Industrials outperformed, while Energy and Health lagged. Further supporting the bullish technology outlook, RBC initiated coverage on NVDA, MU, MRVL, ARM, ASML, AMAT, LRCX, and LSCC with Outperform ratings. The energy sector was weighed down by weakness in crude oil, which continued to relinquish some of its recent gains after President Trump stated that Iran has "no plan" to kill protestors. On the data front, initial jobless claims were impressive, printing at 198k (expected 215k, previous 208k), which contributed to some downside in Treasury values and upside in the Dollar's value. Regional surveys from the New York Fed and the Philadelphia Fed were also solid, with both headline figures surpassing Wall Street expectations. The Dollar strengthened, negatively impacting G10 FX peers, with the British Pound being the laggard, despite a brief period of strength following the GDP report, which exceeded expectations and put Q4 GDP on track to surpass the Bank of England's forecast of no growth. T-Notes flattened, led by the short-end, due to the strong US data. There were numerous Federal Reserve speakers, although little new information was conveyed, with Schmid maintaining his usual hawkish tone. Regarding earnings, Goldman Sachs (GS) and Morgan Stanley (MS) saw gains after their reports, both of which were impressive and helped alleviate some of the concerns induced by JPMorgan Chase (JPM) earlier in the week.

US DATA

JOBLESS CLAIMS: Weekly Initial Claims decreased to 198k in the week ending January 10th, from 207k, marking the lowest print since the week ending November 29th, which was affected by seasonality related to Thanksgiving. The next lowest was seen in January 2024. The four-week average fell to 205k from 211.75k. Continued claims for the preceding week also decreased, to 1.884 million from 1.903 million, although the four-week average remained relatively unchanged. The low claims data is encouraging, and Pantheon Macroeconomics highlights that claims remain low even when accounting for residual seasonality. The desk also notes that while claims have improved, the unemployment rate has increased, suggesting that new entrants to the labor market, who are ineligible for benefits, are finding it difficult to secure their first job. The data aligns with a low-hire, low-firing economy.

IMPORT/EXPORT PRICES: Note: Most of the October data was suppressed due to the US government shutdown, with November monthly figures replaced by the two-month period from September to October. Import prices increased by 0.4% over the two months from September to November, translating to +0.1% year-over-year (expected 0.4%). Prices for nonfuel imports rose by 0.6% over the two months, as higher prices for nonfuel industrial supplies and materials, and for capital goods, more than offset lower prices for automotive vehicles. Fuel import prices declined by 2.5% over the two-month period ending November 2025. Export prices rose by 0.5% over the two-month period and 3.3% on a yearly basis (expected 2.3%). Driving the increase were agricultural export prices, which rose by 1.3% over the two months, with non-agricultural industrial supplies and materials export prices increasing by 4.9% year-over-year.

PHILLY FED: The Philadelphia Fed index impressed in January, with the index for general activity jumping to 12.6 from -8.8, significantly above the expected -2. New orders rose to 14.4 (previous 5.7), while Employment printed at 9.7 (previous 13.0). Business conditions and prices paid came in at 25.5 (previous 38.1) and 46.9 (previous 49.3), respectively. Looking ahead, the diffusion index for future general activity declined from a revised reading of 38.1 in December to 25.5 in January, its lowest reading since July. Nearly 35% of firms expect an increase in activity over the next six months, exceeding the 9% that expect a decrease; 37% expect no change. Overall, the indicators for current activity, new orders, and shipments all rose, with the current activity index turning positive this month. On balance, firms continued to indicate overall increases in prices, and both price indices remained well above their long-run averages. Firms also continued to report higher employment levels, although the employment index edged lower. Most of the survey’s broad indicators for future activity declined but continued to suggest expectations for growth over the next six months.

NY FED: The New York Fed headline for January rose to +7.7 from -3.7, above the expected 1. New orders and shipments both jumped into positive territory at 6.6 (previous -1.0) and 16.3 (previous -5.0), respectively, while unfilled orders improved but remained firmly in negative territory. Inflationary indicators saw both prices paid and received fall, with the former dipping to 42.8 from 44.2, while the latter tumbled to 14.4 from 25.4. Delivery times were unchanged, and inventories edged down, while supply availability worsened slightly. Looking six months ahead, firms remained fairly optimistic about the outlook, with the index for future business conditions printing at 30.3, and roughly half of respondents expecting conditions to improve over the next six months. New orders and shipments are expected to increase. Firms continue to anticipate significant price increases, though notably less than in recent months. Richard Deltz, Economic Research Advisor at the New York Fed, stated, “After a small dip in December, manufacturing activity increased modestly in New York State in January. Selling prices rose at the slowest pace in nearly a year. Firms remained fairly optimistic that conditions would improve.”

FED

BARR: Governor Barr stated that the Department of Justice probe is an assault on the independence of the Federal Reserve, and that the Fed is acting solely for economic reasons and in accordance with its congressional mandate. Barr remarked that benchmark interest rates are at the right level, equally balancing risks to inflation and the job market. He added that a reasonable base case is that the labor market is continuing to stabilize, and that inflation will continue to come down to 2%. Barr is taking a wait-and-see approach and said he'll continue to assess the data. He further remarked that they need to treat the data with some caution, and that will play through into the spring.

GOOLSBEE (2027 Voter): The Chicago Fed President said he is not surprised by the low initial jobless claims numbers, noting the Chicago Fed data showed stability in the labor market. He noted, however, that the low-hiring, low-firing environment does highlight business uncertainty. On inflation, he said that within the CPI and PPI data, there is some encouragement, but there are still things that get his attention. Nonetheless, recent data shows a possible waning of the tariff impact. He noted non-housing services inflation is disturbing, and healthcare inflation is discouraging. On rates, he expects the Fed to cut further this year, but needs data to affirm his outlook. He said that rates can still go down a fair amount.

DALY (2027 voter): The San Francisco Fed President did not say much, but noted the projections for growth are solid; incoming data looks promising, and there is still a lot of uncertainty, with risks to both sides of our mandated goals.

PAULSON (2028 voter): She is comfortable with holding rates steady at the next Fed meeting, and said the labor market risks are a little bit higher than the risks of sticky inflation. Paulson added she wants monetary policy restrictiveness to be playing a role to get them all the way back to 2%. If her baseline outlook for steady growth, declining inflation, and a stable labor market is right, “well, then we should be at neutral,” and the interest-rate setting she thinks is “a little lower than we are now.” On rates, she thinks they are still high enough that they are slightly above a neutral level that neither spurs nor slows growth, and said that was appropriate for the time being to help finish the job of bringing inflation down. Ahead, she would be particularly focused on January price data, because businesses often reset prices at the beginning of the year.

SCHMID (2028 voter): The Kansas City Fed President kept his hawkish stance, arguing that there is little reason to cut rates, preferring to keep policy modestly restrictive with inflation still too hot. Schmid added that cutting rates could worsen inflation without helping employment much, as labor market stresses are structural. On inflation, Schmid noted that the December CPI is consistent with close to 3% inflation, and inflation is a top concern among business contacts. Schmid sees full employment likely between 3.5-4.5%.

BOSTIC (retiring in Feb): He said he expects inflationary pressure to continue in 2026, but GDP to grow upward of 2% in 2026. He argued that many businesses are still incorporating tariffs into prices, and inflation pressure is beyond tariffs, with other factors like medical costs adding to inflationary pressure. Bostic views the labor market as in balance and is not too tight nor too loose. Ahead, he believes that the government shutdown will continue to distort data until April or May. Bostic thinks the Fed needs to stay restrictive because inflation remains high.

FIXED INCOME

T-NOTE FUTURES (H5) SETTLED 8 TICKS LOWER AT 112-07

T-Notes flattened, led by the short-end on strong US data. At settlement, 2-year +4.4bps at 3.564%, 3-year +5.6bps at 3.617%, 5-year +5.2bps at 3.764%, 7-year 4.2bps at 3.956%, 10-year +2.8bps at 4.162%, 20-year +1.1bps at 4.737%, 30-year +0.4bps at 4.790%.

THE DAY: T-Notes had been paring some of the prior day gains overnight, perhaps as some geopolitical risk was unwound after Trump announced Iran will stop the killing and there will be no execution of protestors. However, the most vol was seen in response to the US data, which saw the curve flatten with front-end yields rising on the strong data as it reduces the need for near term rate cuts. The highlight was the jobless claims data, which fell to sub 200k, only the third print to do so in the last two years, which helped quell some labor market concerns. However, desks note that with the rising unemployment rate and falling claims, it echoes the low hiring, low firing economy, with the unemployment rate propped up by those who are new to the workforce and cannot find work, but can also not make a claim due to being recent entrants to the workforce. Meanwhile, both the NY Fed and Philly Fed Manufacturing Indices beat expectations. Elsewhere, Fed speak saw Bostic reiterate calls for policy to stay restrictive, while Goolsbee reiterated that rates can still go down a fair amount, but he wants to see more data to affirm his outlook. Governor Barr said rates are at the right level, equally balancing the risks to inflation and the labor market - seemingly a nod that he thinks that rates are at a neutral level. Elsewhere, with banking earnings largely behind us, several were active in the bond market, with Wells Fargo (WFC), Morgan Stanley (MS) and Goldman Sachs (GS) all filing to sell debt.

SUPPLY

Bills

- The US sold 8-week bills at a high rate of 3.600%, with a bid-to-cover ratio of 2.71x, and sold 4-week bills at a high rate of 3.595%, with a bid-to-cover ratio of 2.92x.

- The US will sell USD 85 billion of 6-week bills (previous 75 billion), USD 89 billion of 13-week bills (previous 86 billion), USD 77 billion of 26-week bills (previous 77 billion), and USD 50 billion of 52-week bills (previous 50 billion) on January 20th, to settle on January 22nd.

STIRS/OPERATIONS

- Market Implied Federal Reserve Rate Cut Pricing: January 0bps (previous 0bps), March 3.3bps (previous 5.7bps), April 8.2bps (previous 10.2bps), December 47.4bps (previous 53.6bps).

- The New York Fed Reverse Repurchase (RRP) operation demand was at USD 2 billion (previous 3.2 billion) across 6 counterparties (previous 15).

- The Effective Federal Funds Rate (EFFR) was at 3.64% (previous 3.64%), with volumes at USD 92 billion (previous 93 billion) on January 14th.

- The Secured Overnight Financing Rate (SOFR) was at 3.64% (previous 3.65%), with volumes at USD 3.148 trillion (previous 3.177 trillion) on January 14th.

CRUDE

WTI (G6) SETTLED USD 2.83 LOWER AT 59.19/BBL; BRENT (H6) SETTLED USD 2.76 LOWER AT USD 63.76/BBL

The crude complex was distinctly lower, paring some of the recent geopolitical-induced strength after Trump said Iran has "no plan" to kill protestors. The key headline came after the settlement on Wednesday, and WTI and Brent have continued to edge lower since the initial plummet to hit lows of USD 58.76/bbl and 63.27, respectively. Today, the geopolitical updates were plentiful, but little market-moving given the Trump remarks on Wednesday night. Nonetheless, the White House said Trump and his team have told Iran that if killing continues, there will be grave consequences, and that all options remain on the table for Iran. Regarding an attack, the NYT reported that Netanyahu asked Trump on Wednesday to delay an attack on Iran, while the WSJ, citing officials, said Trump was told an attack on Iran would not guarantee the collapse of the regime and could spark a wider conflict. As such, it is clear that there is still some ambiguity about how Trump and the US will look to move going forward. Elsewhere, the Greenland position remains much the same with little movement on that footing.

EQUITIES

CLOSES : SPX +0.26% at 6,944, NDX +0.32% at 25,547, DJI +0.60% at 49,442, RUT +0.86% at 2,675

SECTORS: Energy -0.91%, Health -0.58%, Communication Services -0.43%, Consumer Staples -0.03%, Materials +0.33%, Consumer Discretionary +0.41%, Financials +0.43%, Technology +0.50%, Real Estate +0.68%, Industrials +0.93%, Utilities +1.04%.

EUROPEAN CLOSES : Euro Stoxx 50 +0.60% at 6,041, Dax 40 +0.35% at 25,375, FTSE 100 +0.54% at 10,239, CAC 40 -0.21% at 8,313, FTSE MIB +0.44% at 45,850, IBEX 35 -0.30% at 17,643, PSI +0.40% at 8,602, SMI +0.22% at 13,495, AEX +1.43% at 1,011

STOCK SPECIFICS:

- Goldman Sachs (GS) profit exceeded expectations, but revenue fell short; the company raised its quarterly dividend to USD 4.50 per share (previous 4). Fixed Income, Currencies, and Commodities (FICC) sales/trading and equities trading surpassed expectations.

- Morgan Stanley (MS) reported EPS and revenue that exceeded expectations, with a strong revenue breakdown, although FICC missed.

- TSMC (TSM) reported a 35% increase in Q4 profit to a record high, driven by surging demand for AI chips; Net profit and revenue beat expectations with strong guidance for the next quarter.

- BlackRock (BLK) reported EPS and revenue that exceeded expectations, and increased its quarterly dividend by 10%.

- Spotify (SPOT) is increasing prices for Premium subscribers in various regions.

- Boston Scientific (BSX) announced an agreement to acquire Penumbra (PEN) for USD 374 per share, valuing PEN at USD 14.5 billion.

- US President Trump is asking Congress to enact his health-care plan and wants low insurance premiums and insurance companies to be accountable; the plan asks Congress to codify drug-cost lowering deals.

- Ford Motor (F) and BYD (BYDDY) are in discussions on a partnership in which Ford would buy batteries from BYD for some of Ford’s hybrid-vehicle models, according to the Wall Street Journal, citing sources; the two companies are still discussing how the arrangement would work.

- Google (GOOGL) is introducing TranslateGemma, a new collection of open translation models built on Gemma 3, helping people communicate across 55 languages; Duolingo (DUOL) was weighed by the news.

- Coterra Energy (CTRA) is reportedly considering a combination with Devon Energy (DVN) in an oil megadeal, according to Bloomberg.

FX

The Dollar was firmer as hot US claims data added to existing gains from overnight trade. Initial claims unexpectedly fell to its second lowest reading in two years, with continuing claims also falling beneath forecasts. The move saw short-duration yields outperform to the upside, and as such, the buck tracked the move higher. Additional data from regional Fed mfg surveys (NY and Philly) offered optimism thus far for expectations in January, as both readings topped expectations. Ahead of the Fed blackout this weekend, many officials were present. Schmid (2028 voter) unsurprisingly remains a hawk, cautioning against high inflation and a December reading that implies inflation "close to 3%"; Governor Barr views current rates at the right level, equally balancing risks to inflation and the job market. DXY hit highs of 99.49 before trimming gains to ~ 99.31.

G10 FX was generally lower against the buck, with AUD the exception, posting decent strength. GBP underperformed despite a GDP beat in November (Act: 0.3% M/M, exp. 0.1%), leaving Cable at around 1.3363 lows. CHF and EUR also underperformed.

The Japanese Yen was marginally weaker, with Bloomberg reports likely limiting downside, " BoJ is reportedly likely to keep rates steady in January; some officials are said to be concerned over the economic impact of a weak JPY. USD/JPY hit highs of 158.88 before paring to ~158.53.