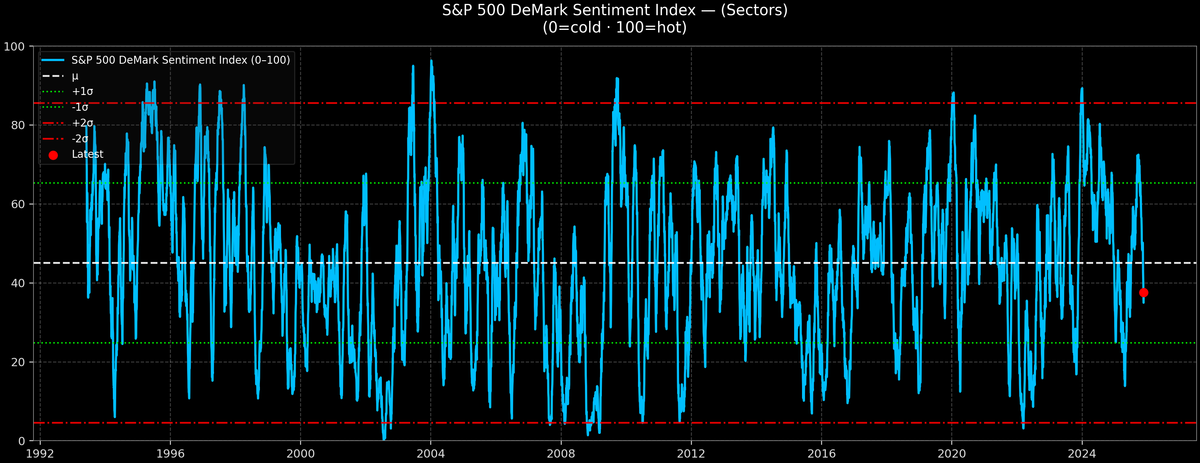

S&P 500 DeMark Sentiment Index — 2025-11-23

The overall sentiment in the US Equity Market is neutral, reflecting a balanced perspective on near-term prospects. While the broader S&P 500 sentiment sits at 37.6/100, a notable divergence exists across sectors.

Leading sectors, demonstrating 'hot' sentiment, include Health Care and Industrials. Lagging sectors, indicating 'cold' sentiment, are Materials, Consumer Discretionary, and Technology. Several sectors, such as Communication Services and Utilities, occupy a neutral position. This divergence suggests investors are favoring defensive sectors while expressing caution towards cyclical areas.

Historically, this neutral sentiment has been associated with modest forward returns for the S&P 500. The median forward SPX returns are 1.2% for 1 month, 1.5% for 3 months, and 3.8% for 6 months. The hit ratios, representing the percentage of times the SPX has been positive over these periods, are 64.5%, 59.2%, and 70.0% respectively. This suggests a landscape of cautious optimism, with limited upside potential in the near term.