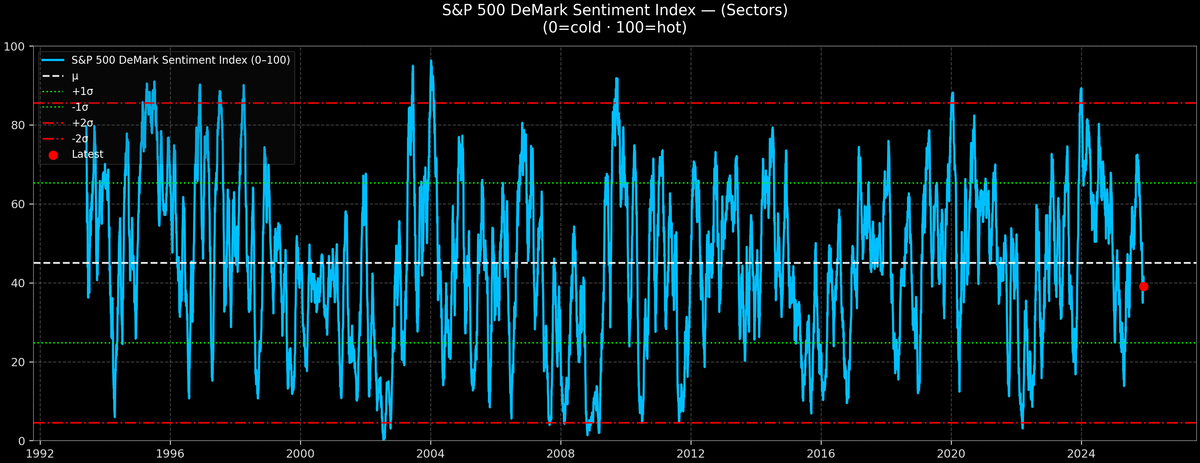

S&P 500 DeMark Sentiment Index — 2025-12-02

The overall sentiment in the US Equity Market is currently neutral, with a score of 39.1/100. This suggests a lack of strong conviction in either direction.

Sector performance is highly divergent. Health Care is leading the way, indicating strong positive sentiment. Industrials and Communication Services are moderately positive. Utilities and Real Estate are closer to neutral. On the other hand, Technology and Consumer Discretionary are lagging, suggesting bearish sentiment. Materials are the coldest sector, reflecting significant pessimism. This divergence suggests investors are favoring defensive sectors while shying away from growth-oriented areas.

Historically, this level of sentiment has been associated with modest positive returns in the S&P 500. Median forward returns have been 1.2% over the next month (with a 65.1% hit ratio), 1.1% over the next three months (56.9% hit ratio), and 4.1% over the next six months (73.6% hit ratio). These figures suggest a cautiously optimistic outlook for the S&P 500.