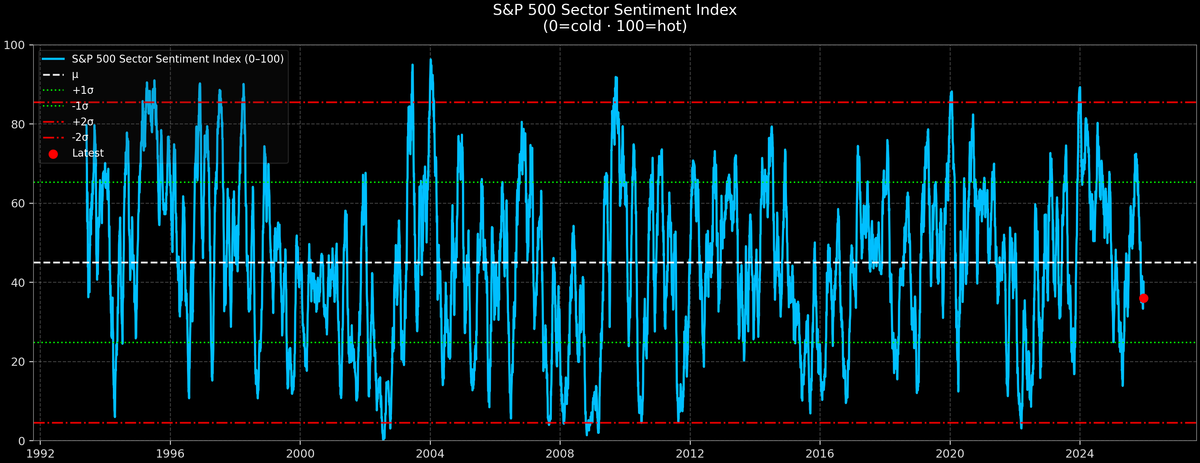

S&P 500 Sector Sentiment — 2025-12-18

S&P 500 Sector Sentiment — 2025-12-18

Current tone: neutral

Latest score: 36.0/100

Cross-sector dispersion: 57.6 pts

In today's market update, the sector sentiment for the S&P 500 is holding steady at neutrality, reflecting an average score of 36.0. The financials and communication services sectors are currently leading the pack, while utilities and materials lag behind. Stay tuned as we delve into the forward return playbook and explore the sector map to better understand this market trend.

Forward return playbook (SPX)

Historical medians and hit ratios from past dates that looked similar to today (conditional on the sentiment regime + a tight score band).

| Horizon | Median SPX | Hit Ratio | N |

|---:|---:|---:|---:|

| 1M | 1.4% | 66.1% | 425 |

| 3M | 1.8% | 64.0% | 425 |

| 6M | 3.3% | 67.3% | 425 |

| 12M | 7.1% | 70.1% | 425 |

Sector map (0=cold, 100=hot)

Leading / Hot

- Financials: 65.9/100

- Comm. Services: 52.8/100

- Health Care: 49.2/100

Lagging / Cold

- Utilities: 8.3/100

- Materials: 10.9/100

- Technology: 15.9/100

Neutral

- Industrials: 44.5/100

- Real Estate: 44.2/100

- Consumer Disc.: 35.8/100

- Consumer Staples: 32.7/100

Read-through

- Higher dispersion usually means stock selection and factor tilts matter more than pure index direction.

- Use the playbook as a bias check, then size risk around the sector map (leaders vs laggards).