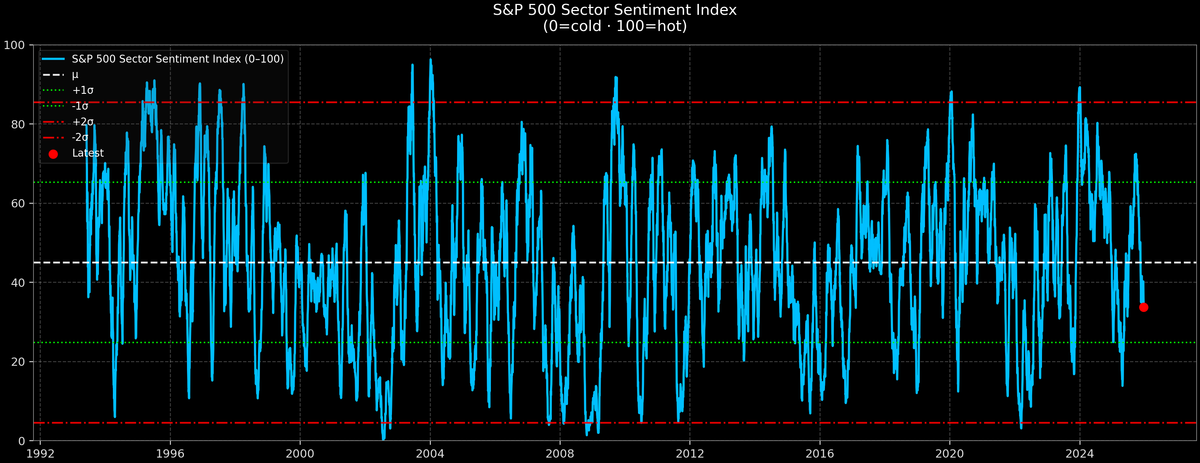

S&P 500 Sector Sentiment — 2025-12-21

S&P 500 Sector Sentiment — 2025-12-21

Current tone: neutral

Latest score: 33.7/100

Cross-sector dispersion: 55.1 pts

In today's market update: The S&P 500 sector sentiment is stable at a neutral tone. Financials and Communications Services are currently in the lead, indicating strong performance. On the other hand, Utilities and Technology sectors have been trailing due to recent challenges. For investors looking ahead, we recommend focusing on financial stocks for potential gains. Additionally, exploring our 'Forward Return Playbook' can provide insights into how these sectors might perform moving forward. Don't miss out on this opportunity; stay tuned for more updates in the sector map section.

Forward return playbook (SPX)

Historical medians and hit ratios from past dates that looked similar to today (conditional on the sentiment regime + a tight score band).

| Horizon | Median SPX | Hit Ratio | N |

|---:|---:|---:|---:|

| 1M | 1.3% | 61.6% | 396 |

| 3M | 2.1% | 67.4% | 396 |

| 6M | 3.4% | 68.7% | 396 |

| 12M | 7.8% | 73.5% | 396 |

Sector map (0=cold, 100=hot)

Leading / Hot

- Financials: 61.9/100

- Comm. Services: 49.5/100

- Health Care: 46.1/100

Lagging / Cold

- Utilities: 6.8/100

- Technology: 17.3/100

- Materials: 17.5/100

Neutral

- Industrials: 45.0/100

- Real Estate: 37.2/100

- Consumer Disc.: 36.8/100

- Consumer Staples: 19.0/100

Read-through

- Higher dispersion usually means stock selection and factor tilts matter more than pure index direction.

- Use the playbook as a bias check, then size risk around the sector map (leaders vs laggards).