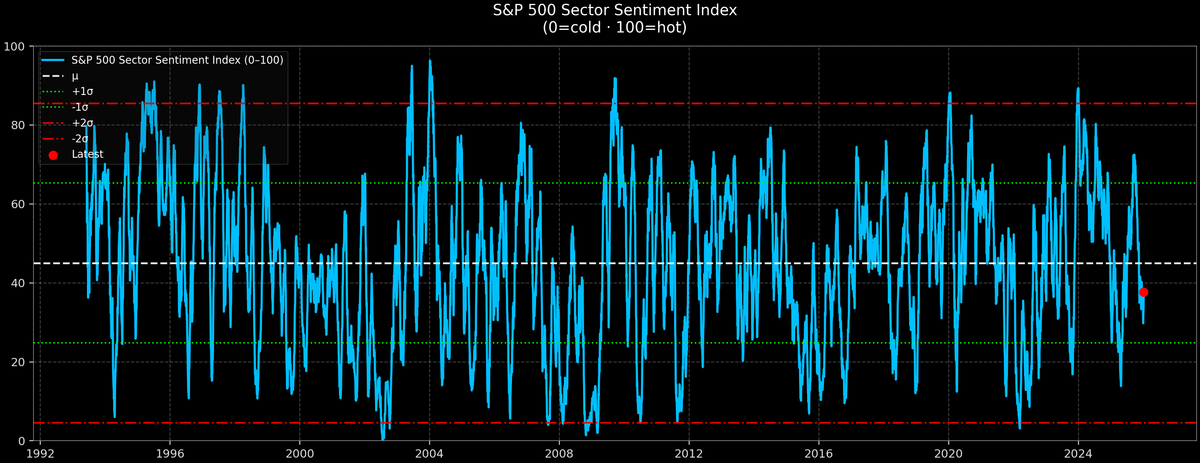

S&P 500 Sector Sentiment — 2026-01-06

S&P 500 Sector Sentiment — 2026-01-06

Current tone: neutral

Latest score: 37.7/100

Cross-sector dispersion: 55.5 pts

In the forward return playbook, we've identified key sectors for your investment strategy. The Financials and Materials leaders offer stability, while Consumer Staples and Technology lag behind. Stay tuned as our sector map updates regularly to help you navigate the market's latest trends.

Forward return playbook (SPX)

Historical medians and hit ratios from past dates that looked similar to today (conditional on the sentiment regime + a tight score band).

| Horizon | Median SPX | Hit Ratio | N |

|---:|---:|---:|---:|

| 1M | 1.0% | 61.9% | 236 |

| 3M | 1.3% | 59.3% | 236 |

| 6M | -0.1% | 49.6% | 236 |

| 12M | 3.4% | 61.0% | 236 |

Sector map (0=cold, 100=hot)

Leading / Hot

- Financials: 62.1/100

- Materials: 56.9/100

- Health Care: 55.0/100

Lagging / Cold

- Consumer Staples: 6.6/100

- Technology: 11.2/100

- Utilities: 13.0/100

Neutral

- Industrials: 51.6/100

- Real Estate: 50.6/100

- Comm. Services: 38.1/100

- Consumer Disc.: 31.6/100

Read-through

- Higher dispersion usually means stock selection and factor tilts matter more than pure index direction.

- Use the playbook as a bias check, then size risk around the sector map (leaders vs laggards).