Weekly Market Wrap — 10–14 November 2025

Summary Highlights

- Week started with risk-on momentum as shutdown optimism and a softer Dollar lifted equities.

- A weak ADP jobs print and cautious Fed rhetoric turned the mood more mixed, with choppy two-way trade.

- By late week, strong China tech/AI updates triggered a sharp de-risking in US big tech and AI leaders.

- Defensives and Dow names outperformed, while Treasuries and gold stayed supported as classic hedges.

Risk assets kicked off the week on solid footing. Equities pushed higher, crude was firmer, the Dollar softened and gold extended gains as headlines pointed to improving US–China trade relations and growing optimism that the record US government shutdown was finally moving toward a resolution. Hopes for a reopening of federal agencies and a return of key economic data helped anchor a clear risk-on tone.

As the week progressed, the narrative became more complicated. A weaker-than-expected ADP employment report revived concerns about the underlying strength of the US labour market. The Dollar came under renewed pressure and Treasuries caught a bid, while equities shifted into more tactical, two-way trade. Intraday swings reflected investors trying to reconcile softer data with still-elevated valuations and the prospect of further Fed easing at some point, without a clear timing signal. Crude prices wobbled but stayed broadly supported, and gold remained in demand as a hedge against both policy and growth uncertainty.

The political backdrop then moved back to the foreground. As the House prepared to vote on legislation to end the shutdown, US indices ended one of the sessions in mixed fashion. The Dow outperformed thanks to strength in heavyweight healthcare and financial names, while the S&P 500 and Nasdaq were roughly flat as rotation away from richly valued growth and AI leaders continued. Sector performance underlined the shift: Health Care, Financials and Materials outperformed, whereas Energy, Communication Services and Consumer Discretionary lagged. At the macro level, firmer Treasuries, softer crude and higher gold prices painted a picture of a market quietly rebuilding hedges even as shutdown relief appeared to be getting closer.

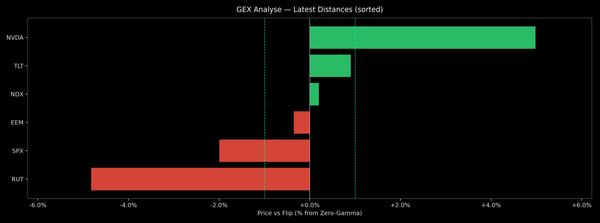

Into Thursday, the mood flipped decisively risk-off. Strong updates and upbeat guidance from major Chinese tech companies showcased their rapid progress in AI and cloud, which in turn weighed heavily on US big tech and AI winners. Investors started to reassess how long US dominance in AI can go unchallenged and whether current valuations already price in a best-case scenario. The Nasdaq and other tech-heavy benchmarks led the downside, the S&P 500 dropped sharply, and small caps also underperformed as de-risking spread across growth and cyclicals. Hawkish tones from several Fed officials, a hotter-than-expected Australian jobs report, a larger US crude inventory build and a flurry of corporate headlines all added to the caution.

By the end of the period, the week had drawn a clear arc: from shutdown-driven relief and Dollar weakness, through a choppy, data-sensitive mid-section, to a late-week risk-off move centred on AI valuations and global tech competition. Cross-asset signals — firmer Treasuries, resilient gold, choppy crude and a less one-way Dollar — suggested a market that is no longer in melt-up mode, but instead weighing political resolution in Washington against lingering concerns over growth, policy and just how far the AI trade has already run. The next leg for risk assets will likely hinge on the eventual shutdown outcome, the return of hard US data, and whether those releases support the “soft-landing with easing” narrative or revive fears of stickier inflation or sharper growth downside.