Weekly Market Wrap — Nov 17–21, 2025

Summary Highlights

- AI valuation fears stayed front and centre, keeping big tech and AI leaders under heavy pressure.

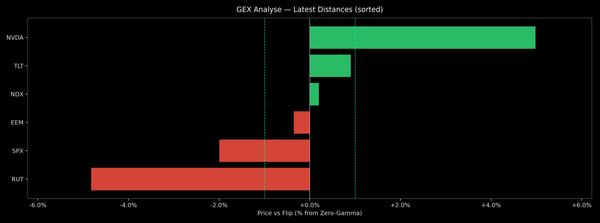

- The S&P 500 broke below its 50-day moving average and later saw another wave of aggressive selling.

- A blowout NVIDIA quarter briefly lifted risk sentiment, but the rally faded fast.

- Fed cut expectations were pared back after hawkish FOMC minutes and a surprise delay to key labour data.

- Treasuries and the dollar traded the tug-of-war between risk-off flows and reduced easing hopes; oil whipsawed on geopolitics and Ukraine peace-talk headlines.

Risk assets spent another week wrestling with the AI narrative. Markets came in already uneasy after a weekend of commentary about stretched AI valuations. Early on, US indices were mixed: the S&P 500 and Nasdaq finished roughly flat while small caps outperformed and the Dow and equal-weight S&P lagged. Sector breadth was soft, but Energy, Technology and Real Estate managed to stand out on the upside. Under the surface, attention was already shifting to the long-delayed US data calendar, with officials firming up release dates for GDP, PCE and payrolls after the shutdown-related blackout.

The tone deteriorated sharply as the week got going. US equities suffered a broad risk-off move driven less by a single headline and more by ongoing discomfort with AI valuations. The S&P 500 slipped below its 50-day moving average, with all sectors in the red except Communication Services and Utilities. Fed speakers added to the unease: Governor Waller reiterated support for another 25bp cut but stressed that inflation is close to target and he sees no catalyst for re-acceleration, while Vice Chair Jefferson again argued for moving more slowly as policy nears neutral. The dollar firmed in a low-liquidity session, G10 FX mostly weakened, and Treasuries found a modest bid as equities sold off, though a chunky Amazon bond deal helped cap the rally.

Mid-week, the pressure on mega-cap growth and AI names intensified. US indices tumbled again, with Consumer Discretionary and Technology underperforming as a major bank downgraded Amazon and Microsoft and called for more caution on the “AI hyperscalers.” Labour data painted a picture of a slowly cooling jobs market: weekly jobless claims held around 232k and high-frequency ADP data showed small net job losses over the prior month. Despite the weaker growth tone, crude oil rallied strongly, helped by a high-profile US–Saudi conference, supply headlines and geopolitical noise in energy-sensitive regions. That mix saw CAD and AUD outperform on the back of firmer commodities, while safe-haven FX like JPY and CHF lagged and the Treasury curve ultimately steepened.

The supposed turning point was NVIDIA’s earnings – and at first glance, they delivered. The company posted a blockbuster Q3 FY26 with revenue and EPS comfortably ahead of expectations, datacentre sales surging on Blackwell and GB300 demand, and guidance that outpaced already bullish Street numbers. The stock jumped over 4% after hours and pulled S&P and Nasdaq futures higher, helping US indices close one session modestly in the green. But at the macro level, the backdrop turned less friendly: the Bureau of Labor Statistics unexpectedly pushed both the October and November employment reports to mid-December, meaning the Fed will go into the December FOMC “flying in the fog,” and FOMC minutes revealed a more divided – but still hawkish-leaning – Committee. Markets sharply trimmed near-term rate-cut pricing, the dollar broke higher, and oil sold off as headlines about a potential US-brokered Russia–Ukraine peace framework hit energy risk premia.

By the end of the week, the post-NVIDIA bounce had fully faded. US indices saw another day of aggressive selling with the S&P 500 down roughly 1.6%, the Nasdaq off more than 2% and small caps also under pressure. Goldman warned that trend-following hedge funds could be forced to unload tens of billions of equities if the slide continues, underscoring how crowded the AI and US growth trade has become. Bitcoin extended its decline to lows not seen since the spring, while Treasuries caught a fresh bid and the dollar retained most of its recent gains. Sector performance spoke to classic de-risking: defensives and select consumer names held up relatively better, while high-beta tech, cyclicals and AI-exposed leaders bore the brunt of the liquidation.

Taken together, the week marked a shift from AI euphoria to AI fatigue. NVIDIA proved that the earnings engine is still running hot, but that was not enough to neutralise valuation concerns, hawkish Fed messaging and a murkier data backdrop. With major US releases now clustered into mid-December and peace-talk headlines swirling around Ukraine, the next leg for risk assets will hinge on whether incoming data and policy signals validate a “slow-growth, lower-rates” story – or force a deeper reassessment of how much AI optimism is already priced in.