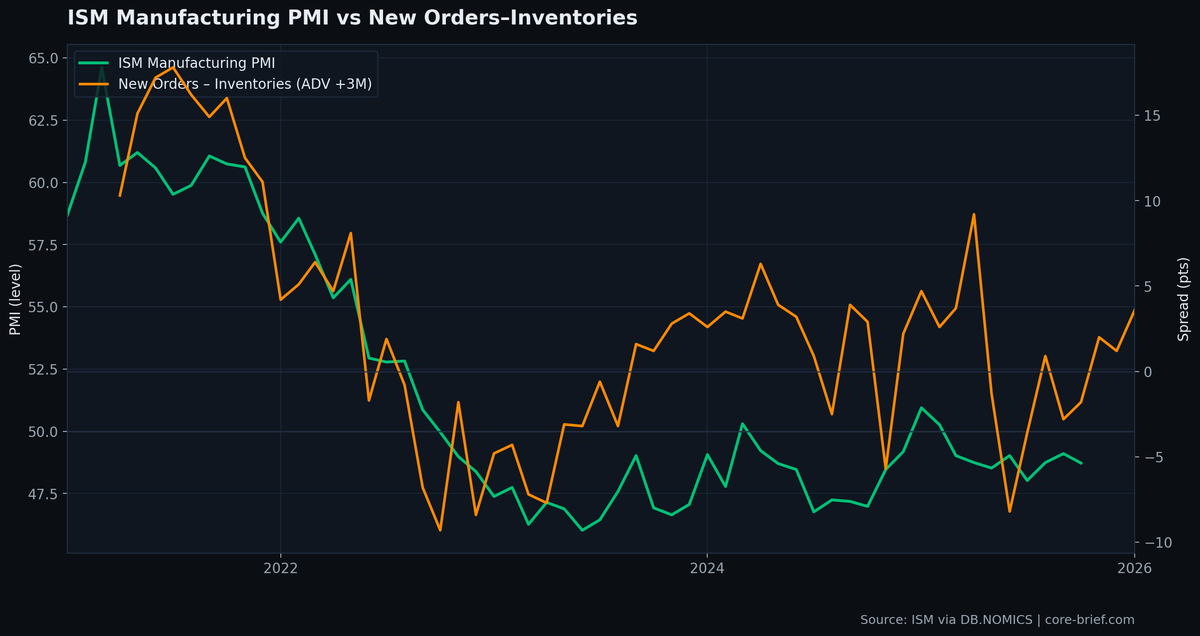

When Orders Outrun Inventories, PMI Usually Wakes Up Next

Manufacturing cycles don’t turn on headlines — they turn on pressure. Pressure builds when customers place orders faster than companies can restock shelves. And it cools when warehouses fill up before demand shows up.

That’s the simple idea behind today’s chart: ISM Manufacturing PMI versus the New Orders–Inventories spread.

Why this spread matters

Think of New Orders as the “front door” of the factory and Inventories as the “back room.”

- If New Orders are rising while Inventories lag, businesses often need to ramp up production, staffing, and purchasing.

- If Inventories build while New Orders soften, it can signal demand is fading and the system is carrying excess stock.

So when the New Orders–Inventories spread moves higher, it often reflects a healthier demand impulse — not just optimism, but a real imbalance that the supply chain has to resolve.

Making the timing visible: advancing the signal

In the chart, we advance the spread by 3 months (ADV +3M). The goal is visual, not magical: it helps you see how shifts in the pipeline can show up before the broader PMI trend adjusts.

When the orange line improves (orders pulling ahead of inventories), the green PMI line has frequently followed with a lag — because production, hiring, and supplier behavior typically respond after the order book changes.

What the latest print is hinting at

The most recent move is a rebound in the advanced New Orders–Inventories spread, which reads as: demand momentum is improving relative to stock on hand. If that persists, it usually supports the idea that PMI has room to stabilize and potentially lift into the next data window.

This isn’t a promise — it’s a framework. But as a cycle indicator, the spread is valuable because it’s rooted in something tangible: orders vs shelves.

Chart & updates: core-brief.com