Market Wrap 2025-10-07

- Senate votes on Democrat and Republican proposals to end the US government shutdown failed to reach the necessary threshold for approval, as anticipated.

- Mahmoud Al-Mardaw, a high-ranking Hamas official, stated that "President Trump's plan is mainly an Israeli plan," while also stressing Hamas's desire to end the conflict.

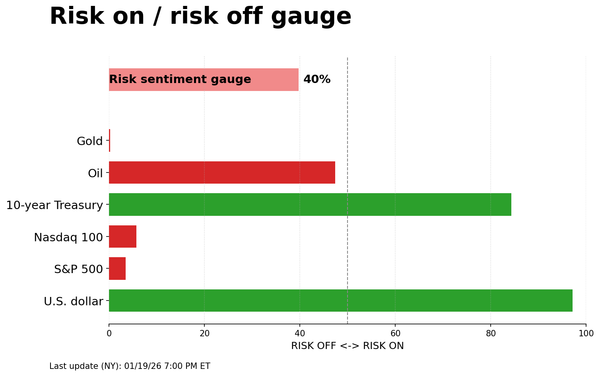

- European stock markets are fluctuating around the flatline, while US equity futures are showing little change or are slightly lower.

- The US dollar is strengthening despite the ongoing deadlock in the US Congress, while the New Zealand dollar is underperforming ahead of the Reserve Bank of New Zealand (RBNZ) meeting.

- There is a general downward trend in global bond markets, with the exception of Japanese Government Bonds (JGBs), which are slightly firmer following new issuance.

- Gold prices have reached new all-time highs near USD 4,000 per ounce, while crude oil prices are stable, with attention focused on geopolitical developments. Regarding supply, Russian Deputy Prime Minister Novak indicated that OPEC+ countries did not discuss increasing quotas by more than 137,000 barrels per day in November.

- Upcoming events include the New York Fed Survey of Consumer Expectations (SCE), Atlanta Fed GDPNow forecast, Canadian Trade Balance for August, Ivey Purchasing Managers Index (PMI) for September, Energy Information Administration (EIA) Short-Term Energy Outlook (STEO), and speeches from Federal Reserve officials Bostic, Bowman, Mester, Kashkari, and European Central Bank (ECB) officials Lagarde and Nagel. There will also be US Treasury supply and earnings from McCormick & Company.

- The releases of US International Trade and Consumer Credit data have been suspended.

TARIFFS/TRADE

- Japan's Chief Cabinet Secretary Hayashi stated that he is aware of US President Trump's comments regarding truck tariffs and that they will assess the details once clarified and respond accordingly.

- Trump is scheduled to meet with Carney on Tuesday at 11:45 AM EDT/4:45 PM BST.

EUROPEAN TRADE

EQUITIES

- European stock markets (STOXX 600 -0.2%) opened mostly lower, with marginal losses. Shortly after the market open, sentiment in Europe turned slightly more negative, although without a clear catalyst.

- European sectors are displaying a slightly more negative picture compared to their mixed opening. Food, Beverage & Tobacco is the best-performing sector, supported by several factors. Imperial Brands (+3%) is contributing to the sector's strength after announcing a GBP 1.45 billion share buyback and reaffirming its FY25 guidance. Additionally, alcohol stocks opened higher, following strong Q2 results from US-listed Constellation Brands (+3.2% pre-market), which exceeded expectations for both revenue and earnings, citing continued demand for its beer portfolio. Diageo (+1%) and AB InBev (+0.7%) are also moving higher. Energy and Telecoms are among the top three sectors, with Shell (+1.7%) benefiting from its expectation of "significantly higher" gas trading in Q3 and a positive outlook for that quarter.

- US equity futures (ES U/C NQ U/C RTY -0.1%) are modestly lower across the board, mirroring the trend observed in Europe during the morning.

FX

- The US Dollar Index (DXY) is extending gains from Monday, driven by weakness in the Japanese yen (JPY) and, to a lesser extent, the euro (EUR). The US government shutdown continues to dominate the US macroeconomic narrative but is not currently weighing on the USD. This assessment may change if the shutdown persists and has a more significant impact on the US economy. The shutdown remains unresolved, with Senate votes on Democrat and Republican proposals to end it failing to secure sufficient support. As a result, mass layoffs of federal workers appear increasingly likely. Today's economic calendar includes US RCM/TIPP Economic Optimism, NY Fed SCE, Atlanta Fed GDPNow forecast, and speeches from several Fed officials, as trade and consumer data releases have been suspended. The DXY has reached a high of 98.47.

- The EUR is weakening against the USD, with EUR/USD returning to the 1.16 level amid ongoing French political risks. Outgoing Prime Minister Lecornu has been instructed by President Macron to hold final discussions with political parties to explore potential solutions. There are three possible outcomes to the current crisis: 1) the appointment of a new Prime Minister, which could appease opposition parties; 2) fresh legislative elections; 3) an early Presidential election. Aside from France, German industrial orders disappointed this morning but had no impact on the EUR. EUR/USD has fallen to a low of 1.1661.

- The JPY is again underperforming against the USD, but to a lesser extent than most G10 currencies. Focus remains on the aftermath of Saturday's Liberal Democratic Party (LDP) leadership election, in which Abe-protégé Takaichi was declared the victor. However, it remains to be seen how much influence the incoming Prime Minister will have on Bank of Japan (BoJ) policy. Investors are looking to scheduled speeches from multiple BoJ officials ahead of the October meeting; however, Governor Ueda's appearance on Wednesday has been cancelled. USD/JPY has reached a high of 150.70, with the next upside target being the August 1st peak at 150.91. Note that Finance Minister Kato attempted to verbally intervene overnight, but it had little impact on the JPY.

- The GBP is softer against the USD but steady against the EUR. In the absence of any tier 1 data, focus in the UK is on the ongoing uncertainty leading up to the November 26th budget. Bloomberg reports that Chancellor Reeves is set to receive an unexpected GBP 5 billion boost to her budget plans from inflation, which raises the taxable value of incomes, profits, and prices. This gain offsets higher debt servicing costs, helping narrow the UK’s projected GBP 20-30 billion budget shortfall ahead of the budget. Cable is trading towards the lower end of Monday's 1.3417-90 range.

- Both the Australian dollar (AUD) and New Zealand dollar (NZD) are underperforming among G10 currencies, with the NZD lagging its antipodean peer ahead of tomorrow's RBNZ rate decision, which is expected to result in a reduction in the Official Cash Rate (OCR). The extent of easing remains uncertain, with a Reuters poll indicating that 15 of 26 economists expect a 25 basis point cut to 2.75%, while 11 anticipate a larger 50 basis point move.

FIXED INCOME

- US Treasuries (USTs) are flat. Trading activity is generally light due to the ongoing government shutdown and the resulting lack of US data. Several Fed speakers are scheduled, but it remains to be seen what they can add beyond recent remarks in the absence of fresh data points. Regarding the shutdown, there are some signs of progress. President Trump commented that he is willing to consider and make a deal on Affordable Care Act (ACA) subsidies, but the government must reopen first. From the Democrats, Senate Minority Leader Schumer said Trump is not yet negotiating with them, but progress on the shutdown is being made. Currently, USTs are trading within a narrow range of 112-11 to 112-15+.

- JGBs gained overnight following a strong 30-year JGB auction. Supply was in greater focus than usual given the move seen in JGBs and particularly the long-end driven steepening that occurred after the weekend’s LDP election. Aside from the auction, the most significant update may be BoJ Governor Ueda's cancellation of his speech on October 8th. This was Ueda’s last scheduled appearance before the end-October BoJ meeting; however, several other officials are scheduled to speak before then. More recently, Takaichi met with the Komeito leader. This meeting was particularly important amid concerns that Komeito could leave the alliance. However, the meeting was positive overall, with agreements reached on two out of three points and talks set to continue on the third; the officials reportedly shared an understanding on history and foreigners.

- French OATs are lower. On Monday, Takaichi met with the Komeito leader. A meeting of particular pertinence amid concern that Komeito could lead the alliance. However, the meeting was positive overall with agreements shared on two out of three points and talks set to continue on the third; the officials reportedly shared an understanding on history and foreigners. Thus far, the OAT-Bund 10-year yield spread is contained within yesterday’s parameters, having reached a high of 86.7 basis points but remaining below the year-to-date peak of 88.2 basis points printed on Monday. As a reminder, the 2024 high is 90 basis points.

- Bunds are softer than USTs but performing better than OATs thus far. For Germany, the main update was another weak industrial orders print for August, a series that is even worse if large orders are excluded. A German Bobl auction was exceptionally weak but had little impact on price action. The market now awaits ECB's Lagarde and Nagel.

- Gilts are also in the red, trading a little softer than Bunds at points throughout the morning but only marginally. The latest tender auction was strong but did not spur any follow-through to the benchmark. For the UK, focus remains on the budget as commentators/desks continue to share their thoughts on what measures Chancellor Reeves may need to take to shore up the UK’s dire finances. Attention is focused on an Oxford Economics note stating that the Office for Budget Responsibility's (OBR) price forecasts are likely to be revised higher, increasing the taxable value of profit and thus providing Reeves with a GBP 5 billion boost.

- The UK sold GBP 1.25 billion of 0.125% 2028 Gilt via tender: bid-to-cover ratio of 3.84x (previous 3.52x), average yield of 3.783% (previous 3.768%).

- Germany sold EUR 3.405 billion versus an expected EUR 4.5 billion of 2.20% 2030 Bobl: bid-to-cover ratio of 1.10x (previous 1.70x), average yield of 2.31% (previous 2.29%), retention of 24.33% (previous 22.42%).

- Saudi Arabia's Public Investment Fund (PIF) is reportedly offering benchmark-sized EUR-denominated green bonds, according to Bloomberg, citing sources; three- and seven-year maturities are reportedly offered.

- Combined order books for Saudi Arabia's green benchmarks exceed EUR 6.5 billion, according to IFR.

COMMODITIES

- Crude oil benchmarks are subdued despite limited crude-specific news flow at the start of the European session. WTI and Brent have been oscillating in a range of approximately USD 0.70-0.80 per barrel and remain relatively flat on the session. Earlier in the session, Russian Deputy Prime Minister Novak stated that OPEC+ did not discuss increasing quotas by more than 137,000 barrels per day and that increasing quotas after November was not discussed. WTI November is trading in a range of USD 61.36-62.04 per barrel, and Brent December is trading in a range of USD 65.16-65.84 per barrel.

- Spot gold has pared back from all-time highs formed early in the APAC session as the yellow metal continues to rise towards USD 4,000 per ounce. XAU peaked at a new all-time high of USD 3,977 per ounce before falling back into the prior day's range and is currently trading around USD 3,950 per ounce. Spot gold is currently trading in an intraday range of USD 3,941.06-3,977.40 per ounce.

- Base metals remain calm following last week’s gains in copper, which saw the largest weekly gain since April due to supply outages. 3-month LME Copper is oscillating in a tight band of USD 10.66-10.75k per tonne, as the market awaits China to return from holiday.

- Russian Deputy PM Novak says OPEC+ nations did not discuss increasing quotas by more than 137k BPD in November. Increasing quotas after November was not discussed.

- Ukraine's Energy Minister, following the Russian attack, says discussed with G7 additional gas imports; wants to increase gas imports by 30%. Ukraine is considering increasing LNG imports.

- Slovakian PM Fico says the nation has signed an agreement with the US for the construction on a new nuclear power plant.

NOTABLE DATA RECAP

- German Industrial Orders MM (Aug) -0.8% vs. Exp. 1.1% (Prev. -2.9%)

- UK Halifax House Prices MM (Sep) -0.3% vs. Exp. 0.2% (Prev. 0.3%, Rev. 0.2%); YY (Sep) 1.3% (Prev. 2.20%, Rev. 2.0%)

- French Trade Balance, EUR, SA (Aug) -5.53B (Prev. -5.56B, Rev. -5.74B); Exports, EUR (Aug) 51.8B (Prev. 52.117B, Rev. 51.84B); Imports, EUR (Aug) 57.33B (Prev. 57.674B, Rev. 57.58B)

NOTABLE EUROPEAN HEADLINES

- French President Macron reportedly believes the current political situation can be turned around and the Socialist Party and Les Republicans will return to the negotiating table, according to Politico, citing sources.

- French National Rally (RN) leader Bardella says both options of fresh legislative elections and advanced presidential elections are on the table.

NOTABLE US HEADLINES

- Fed's Schmid (2025 voter) said the Fed must maintain inflation credibility, while he noted inflation is too high, and it is worrying that price increases are becoming more widespread. Schmid also commented that monetary policy is appropriately calibrated and is only slightly restrictive, while he stated that the labour market is cooling but remains healthy and that tariffs are expected to have a muted effect on inflation.

- US President Trump said layoffs could be triggered if the Senate vote on the shutdown fails, while he added that negotiations are ongoing with Democrats and he would make a deal on Affordable Care Act subsidies. Trump later posted "Democrats have SHUT DOWN the United States Government right in the midst of one of the most successful Economies, including a Record Stock Market, that our Country has ever had...I am happy to work with the Democrats on their Failed Healthcare Policies, or anything else, but first they must allow our Government to re-open."

- US Senate Democrat Leader Schumer said Democrats will be at the table if President Trump is ready to work with Democrats on ending the government shutdown and get something done on health care for American families, while Schumer stated that Trump is not yet negotiating with US Congress Democratic leaders. Furthermore, he separately commented that they are making progress on the government shutdown.

- Democrat and Republican bills to end the US government shutdown failed to secure sufficient votes for passage in the Senate, as expected.

- US President Trump said he would invoke the Insurrection Act if people were being killed, and courts and local officials were holding us up, while it was later reported that Trump said what's happening in Portland is insurrection, according to a Newsmax interview. Furthermore, Trump said he called into federal service at least 300 members of the Illinois National Guard until the governor consents to a federally funded mobilisation.

- US federal judge declined to immediately block President Trump's deployment of National Guard troops to Illinois, according to the New York Times.

- Trump administration officials are said to be exploring options to sell off parts of the federal government’s USD 1.6 trillion student loan portfolio to the private market, according to Politico sources.

- US White House memo says furloughed federal workers are not entitled to back pay for the time that is taken off during the government shutdown, according to Axios.

- Punchbowl, on the US government shutdown, surmises that "There’s no resolution to the crisis in sight." and the outlook is "pretty grim".

GEOPOLITICS

MIDDLE EAST

- Senior Hamas official Mahmoud Al-Mardaw says "President Trump's plan is mainly an Israeli plan"..." The resistance will not accept an agreement that does not end the war or one that can represent a reversal of the rights of the Palestinian people" . "Hamas emphasizes that it wants to end the war, and if the United States is serious about the aspiration to end the war, it must conduct negotiations and take into account the Palestinian demands". "According to him, in the event that negotiations do not lead to an agreement, "the door will not be closed to any real diplomatic effort aimed at ending the war".

- "Indirect talks between Israel and Hamas are 'positive' and to resume Tuesday", according to Sky News Arabia.

- US President Trump said he did not tell Israeli PM Netanyahu to stop being negative about a deal, while he added that Hamas has been agreeing to things that are very important and he expects a Gaza deal soon. Trump said that he spoke with Turkish President Erdogan and noted a strong signal from Iran that they'd like to see this done, while Jordan's King also discussed the Gaza plan with President Trump.

- Egyptian media reported that the round of negotiations between Hamas and the mediators ended amid a positive atmosphere, according to Al Arabiya.

- Iranian media reports that 2 people have been killed from the Revolutionary Guard in an attack West of the country.

RUSSIA-UKRAINE

- US President Trump said he has made a decision on sending Tomahawk missiles to Ukraine, but wants to make sure what they are doing with them first, while Trump added that he is not looking to see an escalation regarding Russia-Ukraine.

- EU governments agreed to limit travel of Russian diplomats within the bloc following a surge in sabotage attempts that intelligence agencies say are often led by spies operating under diplomatic cover, according to FT.

OTHER

- US President Trump called off the diplomatic outreach to Venezuela, according to The New York Times.

CRYPTO

- Bitcoin is essentially flat, whilst Ethereum outperforms and currently resides around USD 4.6k.

APAC TRADE

- APAC stocks traded mixed despite the tech-led advances on Wall St with several holiday closures including Mainland China, Hong Kong and South Korea, while Japanese stocks rallied again as the post-LDP election euphoria persisted.

- ASX 200 was subdued amid losses in Telecoms, Consumer Discretionary and Tech, with sentiment also not helped by weaker Consumer Confidence.

- Nikkei 225 printed fresh record highs once again amid ongoing tailwinds from the dovish expectations associated with the incoming Takaichi government, while Japanese Household Spending also topped forecasts.

NOTABLE ASIA-PAC HEADLINES

- Japanese LDP chief Takaichi said she is truly hoping to work together with US President Trump to make their alliance even stronger and more prosperous, as well as advance a free and open Indo-Pacific.

- Japanese Finance Minister Kato said it is important for currencies to move in a stable manner, reflecting fundamentals, while he added they are closely watching FX moves and will thoroughly monitor for excessive fluctuations and disorderly movements in the forex market. Furthermore, he said the new LDP leader Takaichi will make appropriate policies given Japan's fiscal situation.

- US FCC is to vote this month to tighten restrictions on Chinese equipment posing a national security risk, according to the FCC Chair.

- RBNZ is establishing a new Financial Policy Committee which will be given authority to make key policy decisions relating to financial stability.

- World Bank raises China's 2025 GDP growth forecast to 4.8% (prev. 4.0%), and 2026 forecast to 4.2% (prev. 4.0%), but warned of slowing momentum next year.

- Japan's Komeito Party Leader Saito says LDP leader Takaichi explained her stance on "our" concerns; says they have a shared understanding on history and foreigners, according to Bloomberg; talks will continue.

- Japanese LDP Leader Takaichi, following talks with Komeito party, says "We discussed three points, shared agreements on two".

- UMC (2303 TT) September 2025 sales +52% Y/Y; Jan-Sept sales +2.2% Y/Y.

DATA RECAP

- Japanese All Household Spending MM (Aug) 0.6% vs. Exp. 0.1% (Prev. 1.7%)

- Japanese All Household Spending YY (Aug) 2.3% vs. Exp. 1.2% (Prev. 1.4%)

- Australian Consumer Sentiment Index (Oct) 92.1 (Prev. 95.4)

- Australian Consumer Sentiment MM (Oct) -3.5% (Prev. -3.1%)