Market Wrap 2025-10-10

- Asia-Pacific equities mostly declined, mirroring the negative performance on Wall Street.

- It was reported that China has initiated a customs crackdown on NVIDIA (NVDA) AI chips, according to the Financial Times. US President Trump commented that perhaps the US will have to cease importing substantial quantities from China.

- The US Bureau of Labor Statistics is reportedly preparing to release the September US CPI report despite the government shutdown, according to the New York Times. Bloomberg sources indicated that staff have been recalled to prepare the publication by the end of the month.

- Japanese Finance Minister Kato stated that they have recently observed rapid, one-sided movements, and it is important for currencies to move stably, reflecting underlying fundamentals.

- European equity futures suggest a quiet open for cash markets, with Euro Stoxx 50 futures down 0.1% after Thursday's cash market close with losses of 0.4%.

- Upcoming highlights include Norwegian CPI (August), the Canadian Employment Report (September), the US University of Michigan Preliminary report (October), Chinese M2/New Yuan Loans (September), and speeches from Fed officials Daly, Goolsbee, and Musalem.

SNAPSHOT

Newsquawk in 3 steps:

- Subscribe to the free premarket movers reports

- Listen to this report in the market open podcast (available on Apple and Spotify)

- Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

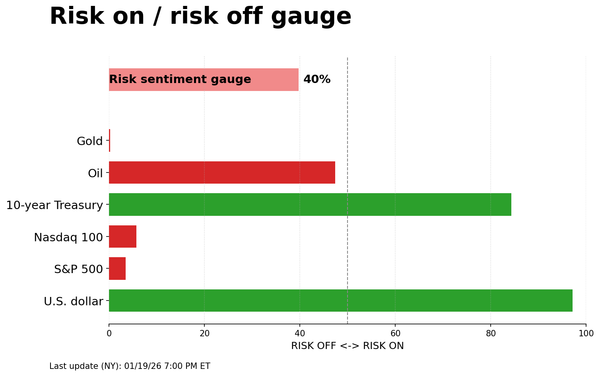

- US stocks experienced declines, appearing to be a retracement of recent gains. Stocks and precious metals sold off from record highs, while the US Dollar strengthened. There was no specific catalyst, but profit-taking or overextended positioning were likely factors. US-China relations were strained by China's implementation of rare earth export controls, and Trump's suggestion that the US might halt massive imports from China.

- The weakness in stocks was widespread, with most sectors declining. The equal-weighted S&P 500 underperformed. Conversely, the Nasdaq "outperformed" due to continued gains in NVIDIA (NVDA), which reached highs of USD 195 per share.

- SPX closed at 6,735, down 0.28%; NDX closed at 25,098, down 0.15%; DJI closed at 46,358, down 0.52%; RUT closed at 2,469, down 0.61%.

- Click here for a detailed summary.

TARIFFS/TRADE

- China reportedly launched a customs crackdown on NVIDIA (NVDA) AI chips, according to the Financial Times, which reported that China has increased enforcement of controls on chip imports, as Beijing aims to reduce the reliance of its tech companies on US products, such as NVIDIA's AI processors.

- US President Trump stated that the US might have to stop importing massive amounts from China and that he wants to discuss soybeans with Chinese President Xi. Regarding China's export controls, he said that Commerce Secretary Lutnick and Treasury Secretary Bessent would address the issue.

- US President Trump said tariffs are beneficial if a country wants to be rich, influential, and powerful, but that opposing tariffs would lead to a third-world country.

- US Treasury Secretary Bessent said he expects the Chinese to resume soybean purchases at the end of the season. Bessent also said India will begin rebalancing its oil purchases in the coming weeks and months, favoring US oil and reducing Russian oil imports.

- The US President Trump's administration said the US and Saudi Arabia are making progress on an agreement to allow US chip companies to export semiconductors to Saudi Arabia and could finalise a deal soon, according to the Wall Street Journal.

- The US Commerce Department is reportedly investigating Singapore-based Megaspeed for potential violations of chip export rules, specifically whether it helped Chinese companies circumvent these rules, according to the New York Times. The NYT noted that Megaspeed is set to purchase USD 2 billion of NVIDIA (NVDA) AI technology in the next year.

- Japan's government said tariff negotiator Akazawa spoke with US Commerce Secretary Lutnick by phone, and they confirmed to smooth the implementation of the trade agreement to further strengthen ties.

- Indian PM Modi said he spoke with US President Trump and reviewed the good progress achieved in trade negotiations, while they agreed to stay in close touch over the coming weeks.

NOTABLE HEADLINES

- Fed Governor Barr (voter) said uncertainty about both inflation and jobs warrants a cautious approach to any further interest rate cut, while he added that the rate cut in September was appropriate, but current policy rates are still modestly restrictive. Furthermore, he said the current outlook poses challenges for judging the stance of monetary policy and deciding the right path forward.

- Fed Governor Barr (voter) said he does not think there is a generalised spillover of tariffs into services inflation, and some components of services inflation stem from higher stock prices. Barr added there's a lot of resilience in the US economy and that the effects of AI in the short term are likely smaller than anticipated, while AI is likely to have profound effects on the economy in the medium and long term.

- Fed's Kashkari (2026 voter) said he "basically agrees" with everything that Fed's Barr said.

- Fed's Daly (2027 voter) said inflation has come in much less than had feared and the labour market is to a point where softening looks like it could be more worrisome if they don't risk manage it, while she added that policy is still modestly restrictive after the September rate cut and the Fed is also projecting more cuts, part of risk management.

- The Federal Reserve Board announced expanded operating days of two large-value payments services, Fedwire® Funds Service and the National Settlement Service (NSS), to include Sundays and weekday holidays.

- US Treasury Secretary Bessent is finalising the first round of interviews for the next Fed Chair this week, according to FBN citing sources. It was also reported that Former Fed governor Larry Lindsey withdraws name from consideration for US Fed Chair position, according to CNBC.

- US President Trump said some Democrats are calling him to reopen the government, and he will be making permanent cuts to Democratic programmes in the shutdown.

- US House Speaker Johnson said the House remains on a 48-hour notice to return to Washington, according to Punchbowl, while it was noted that "This is a sign that the House does not plan to come back next week -- as of now".

- The US Bureau of Labor Statistics is preparing to release a September CPI report despite the shutdown, according to the New York Times. Bloomberg sources suggested staff have been recalled for the preparation of the publication of the report by the end of the month. The US CPI was scheduled to be released on October 15th.

- New York Attorney General Letitia James was indicted by the US Department of Justice, while she stated that the indictment is nothing more than a continuation of the President's desperate weaponisation of the justice system, and she will fight these baseless charges aggressively.

- US President Trump said they made pharmaceutical deals with numerous companies and the US is winning disputes with countries on drug pricing.

- US President Trump will make an announcement in the Oval Office from 17:00 EDT/22:00 BST on Friday.

- US Agriculture Secretary Rollins said once the shutdown is over, they will be able to roll out the programme for farmers.

APAC TRADE

EQUITIES

- Asia-Pacific stocks were mostly lower, following the negative performance on Wall Street, where the stock market and gold prices retreated from record levels. The KOSPI outperformed its regional peers upon returning from an extended holiday.

- The ASX 200 lacked direction amid quiet catalysts, as weakness in the mining and materials sectors offset strength in tech and financials.

- The Nikkei 225 retreated following firmer-than-expected PPI data. Participants also digested earnings updates, including from index heavyweight Fast Retailing, which was the biggest gainer after reporting a double-digit percentage increase in 6-month net.

- The Hang Seng and Shanghai Comp conformed to the downbeat mood as trade frictions resurfaced following China's announcement of export controls on rare earth and items related to lithium batteries, while US President Trump commented that maybe they will have to stop importing massive amounts from China.

- US equity futures eked marginal gains in a frail attempt to nurse some of the prior day's losses.

- European equity futures indicate an uneventful/subdued cash market open with Euro Stoxx 50 futures -0.1% after the cash market closed with losses of 0.4% on Thursday.

FX

- The DXY traded flat overnight, pausing its recent strengthening trend. Comments from Fed officials had little impact on price action, with Barr advocating for a cautious approach and stating that recent spending data suggested strong Q3 GDP growth, while Daly said inflation has come in much less than had feared and the labour market is at a point where softening looks like it could be more worrisome if they don't risk manage it. Furthermore, there is a continued lack of progress regarding the government shutdown impasse, although it was reported that the Bureau of Labor Statistics is preparing to release the September CPI report despite the shutdown.

- EUR/USD marginally rebounded from the prior day's lows, but the recovery was limited by a lack of bullish drivers. The single currency remained below 1.1600. The prior day's ECB minutes lacked significant developments and reiterated that there was no immediate pressure to change rates at the meeting.

- GBP/USD recovered some losses, returning to the 1.3300 level, but upside was capped amid quiet newsflow.

- USD/JPY gradually retreated beneath 153.00 following firmer-than-expected PPI data and repeated warnings from Japanese Finance Minister Kato.

- Antipodeans clawed back some of the prior day's losses after the PBoC strengthened the yuan reference rate setting, but gains were contained amid subdued risk sentiment and a lack of notable data releases.

- US Treasury Secretary Bessent said they directly purchased Argentine Pesos (ARS) and have finalised a USD 20bln currency swap framework with Argentina’s central bank.

FIXED INCOME

- 10yr UST futures rebounded from the prior day's trough, but upside was capped following an average 30yr US auction.

- Bund futures recovered some losses in quiet trade amid a lack of pertinent catalysts and tier-1 releases scheduled for the bloc.

- 10yr JGB futures remained afloat but lacked conviction following firmer-than-expected PPI data from Japan.

COMMODITIES

- Crude futures were lacklustre after trimming some of their weekly gains yesterday amid a rising dollar and Gaza agreement.

- Saudi crude oil supply to China is set to fall to about 40mln barrels in November vs 51mln barrels in October, according to sources cited by Reuters.

- US President Trump said gasoline is to be below USD 2 in the near future.

- Spot gold remained subdued after pulling back from record highs to beneath the USD 4,000/oz level.

- Copper futures declined amid the mostly downbeat mood, including in its largest buyer, China, as trade tensions resurfaced.

CRYPTO

- Bitcoin traded indecisively but with downside cushioned by a floor around the USD 121k level.

NOTABLE ASIA-PAC HEADLINES

- Japanese Finance Minister Kato said they are recently seeing one-sided, rapid moves, and it is important for currencies to move in a stable manner reflecting fundamentals, while he added they will thoroughly monitor for excessive fluctuations and disorderly movements in the forex market.

DATA RECAP

- Japanese Corp Goods Price MM (Sep) 0.3% vs. Exp. 0.1% (Prev. -0.2%)

- Japanese Corp Goods Price YY (Sep) 2.7% vs. Exp. 2.5% (Prev. 2.7%)

GEOPOLITICS

MIDDLE EAST

- Israeli PM Netanyahu's office said Israel's government approved the Gaza plan for the release of all hostages. It was earlier reported that the Israeli PM's office said forces will not leave Gaza unless they are guaranteed there is no threat posed, while it added the mission in Gaza is not over.

- Hamas chief said they declared an end to the war today and the start of a permanent ceasefire, while the agreement includes opening the Rafah crossing in both directions and will see the release of all jailed Palestinians. Furthermore, the group received guarantees from mediators and the US administration confirming that the war has completely ended.

- US President Trump said they ended the war in Gaza and thinks there will be lasting peace, while he said hostages will be released on Monday or Tuesday. Furthermore, he will try to go to the Middle East and will have a signing in Egypt.

- US President Trump said Iran wants to work on peace and that he will work with Iran.

- US President Trump's special Envoy Kushner said "We’ve made a deal here that isolates Hamas and encourages actors in the Arab world to pursue peace. This agreement ensures Israel’s security. If we need to act with force, we will. It will either happen the easy way or the hard way."

- US senior official said, hopefully, the Gaza deal will lead to an opportunity to expand the Abraham Accords. It was also stated that there will be 200 US troops deployed for Gaza as part of a joint task force which will include troops from Egypt and Qatar.

- Yemen's Houthi leader said the group is to monitor Israel's compliance with the Gaza ceasefire agreement and will resume support for Gaza if Israel breaches the agreement.

RUSSIA-UKRAINE

- US President Trump said the Russia-Ukraine war will be solved and that he might impose more sanctions on Russia.

- Ukrainian Energy Ministry said Russian forces launched mass attacks on Ukrainian energy targets, while a Ukrainian official later stated that electricity was cut off in the entire eastern Ukraine following the Russian attack, according to Sky News Arabia.

OTHER

- The UN Security Council will meet on Friday regarding tensions between the US and Venezuela, according to diplomats.

- Taiwan's President said they will accelerate their building of the T-Dome and establish a rigorous air defence system in Taiwan with multi-layered defence, high-level detection, and effective interception.

More

markets stories on ZeroHedge