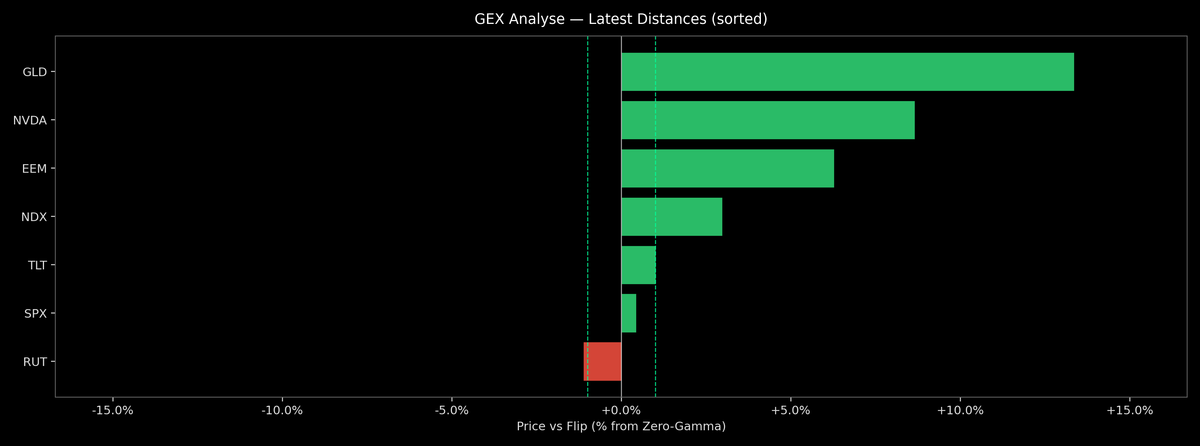

Price / Gamma Flip — 2025-10-07

This dashboard ranks each asset by where price sits relative to its options gamma ‘flip’ (zero-gamma) level. Names above the flip (green) tend to see dealer hedging dampen moves; below the flip (red) can see moves amplified. These dynamics can evolve quickly as open interest shifts. Top above-flip: GLD (+13.4%), NVDA (+8.7%), EEM (+6.3%), NDX (+3.0%), TLT (+1.0%), SPX (+0.4%) Top below-flip: RUT (-1.1%) Click any ticker to view its strike-by-strike Net GEX with a scaled gamma profile, spot/flip markers, and the AI-generated Conclusion beneath the panel.